Ready to feast

Asia is picking up on the halal industry's potential with the food sector the key driver of growth

Malaysian billionaire Halim Saad once said: "Halal is the biggest and the oldest brand in the world."

The Economist Intelligence Unit, the research arm of the Economist publishing group, validates this statement. It has forecast that by 2030, the global halal market will jump to $10 trillion from the current level of $1 trillion. And a major share of this growth hinges on the Asian economies.

"There is a huge and expanding demand for halal products and services all over the world, and Asia is of course one of the primary markets," says Abdalhamid Evans, founder of Imarat Consultants, a UK-based consultancy specializing in halal market intelligence and expertise.

Halal, an Arabic word that means "permissible", refers to any object or action which is allowed to be used or engaged with, according to Islamic law. This covers not only food and drink but also all matters of daily life including investments, banking, cosmetics, pharmaceuticals, fashion, travel, media, entertainment and recreation.

Halal food consumption, in particular, is regarded as a key driver of the growth of the global food industry. The chief factor driving the halal food market is the growing Muslim population across the world.

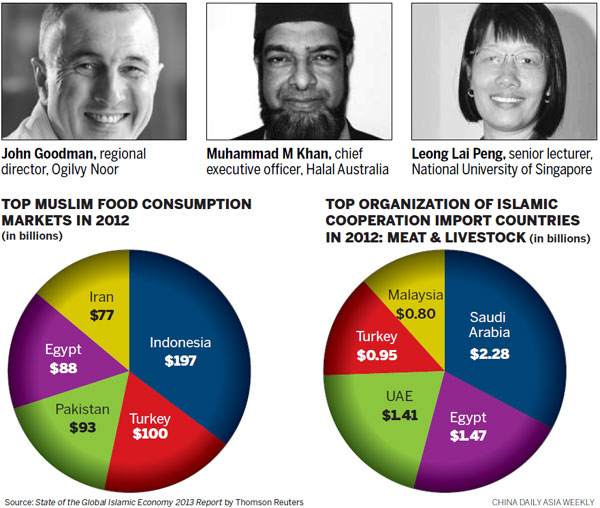

According to a report, State of the Global Islamic Economy 2013, by Thomson Reuters and DinarStandard, Muslim people globally spent just more than $1 trillion in food and non-alcoholic beverages (F&B) in 2012, which is 16.6 percent of global expenditure. It is expected to grow to a $1.6 trillion market by 2018.

"The collective global Muslim F&B market is larger than the F&B consumption of China, which is $848 billion, followed by the United States at $736 billion, Japan at $486 billion and India at $376 billion," the report said.

The International Monetary Fund estimates that the 57 member countries of the Organization of Islamic Cooperation, which represent 8.9 percent of global GDP, are growing at a faster rate than the global economy.

The projected growth of the OIC markets from 2013 to 2018 is expected to be an average of 6.3 percent, compared with the global average of 5.3 percent.

In addition, it is expected that the international Muslim population will grow at about twice the rate of the non-Muslim population over the next two decades - with an average annual growth rate of 1.5 percent for Muslims compared with 0.7 percent for non-Muslims - making them an attractive market for food companies. At present, Muslims constitute about 23 percent of the world's population.

A report by the Pew Research Center, a US-based think tank that conducts demographic and social research, said that the global Muslim population is expected to remain comparatively youthful for decades to come.

"By 2030, 29 percent of the global young population (aged 15 to 29) is projected to be Muslim," it said.

Around 62 percent of the world's Muslims live in South and Southeast Asia. The largest Muslim population is in Indonesia, home to 203 million Muslims, followed by Pakistan (174 million), India (161 million), Bangladesh (145 million), Iran (73.7 million), Turkey (73.6 million) and China (2.2 million).

Many of these Asian nations are seeing a rise in overall per capita income, giving Muslim people more cash to spend than ever before. Spotting this opportunity for substantial growth in the halal industry, many global food giants are turning to Southeast Asia to establish production centers for halal foods.

US food manufacturer Kellogg's Co, for example, is building a $130 million halal facility in Malaysia and is planning to expand its supply chain capacity in the Asia-Pacific region. Ajinomoto Group, a Japanese food and chemical corporation, has also decided to build a manufacturing facility to streamline its global halal supply chain.

South Korean biotechnology firm BioLeaders Corp is collaborating with the Brunei government in research and technical cooperation for the development of halal products.

Japanese mayonnaise brand Kewpie already operates a halal-certified plant in Malaysia, with plans to start production of mayonnaise products and sandwich fillings in Indonesia soon. Frozen food maker Nichirei has also received halal certification for its plant in Thailand.

And US chocolate maker Hershey also plans to build a large-scale factory in Malaysia to make halal-certified products for export to 25 countries and regions, mostly in Asia.

Global food manufacturers are finding a lucrative halal market in Asia, not only because of increased purchasing power, but also resulting from the demand for more diversified products by both affluent Muslim and non-Muslims.

"To capture a wider halal market, various countries are launching initiatives to encourage start-ups to enter into the halal market, as well as training already-existing small and medium-sized enterprises on how to access this market. Both Malaysia and Singapore have government-led projects to do this," says John Goodman, regional director at Thailand-based Ogilvy Noor, an Islamic branding and marketing consultancy.

"There are also collaborations being discussed between Malaysia and Thailand to grow the halal market," he adds. "Some discussions have been raised to combine the halal certifications of Malaysia, Singapore and Brunei in order to consolidate the halal markets that they feed into."

Quality is another factor. The strict standards used in halal production appeal to some non-Muslims. This could become a significant selling point.

"There is a vast opportunity for halal products and related services in Asian markets because of the quality of the products and services," says Hamzah Mohd Salleh, director of the International Institute for Halal Research and Training at the International Islamic University Malaysia.

"To realize this opportunity, halal producers should have trained and competent personnel, a variety of quality halal products and should conduct innovative and aggressive promotions," he says.

Tapping into the halal world, China is building a halal industrial park - to integrate research, design, manufacturing, processing and trade - in the Ningxia Hui autonomous region, home to the Islamic Hui ethnic group.

Officials have stated that "favorable business policies and the good environment can promote the halal food industry in China". The region has 176 halal food enterprises with a total size of $2.16 billion.

China has also signed halal food agreements with various countries, including Saudi Arabia, Egypt, Qatar and Malaysia.

"Halal certification gives companies a competitive edge, so they can sell to a larger pool of consumers and can also export to more countries in the region. In terms of hygiene, they are better than those without any certification," says Leong Lai Peng, senior lecturer on the food science and technology program at the National University of Singapore.

Experts say that some non-Muslims are also purchasing halal foods for health and moral reasons.

"Halal products are seen to be more natural and ethical. It complements a modern lifestyle," says Muhammad M Khan, chief executive officer of Halal Australia, a government-accredited halal certifying body in Australia. "Halal is a brand of a modern day requirement."

China Daily

(China Daily USA 03/31/2014 page16)