Initiative backs growth along Belt, Road

By He Tianjie/Louis Kuijs | China Daily | Updated: 2017-05-04 07:29

|

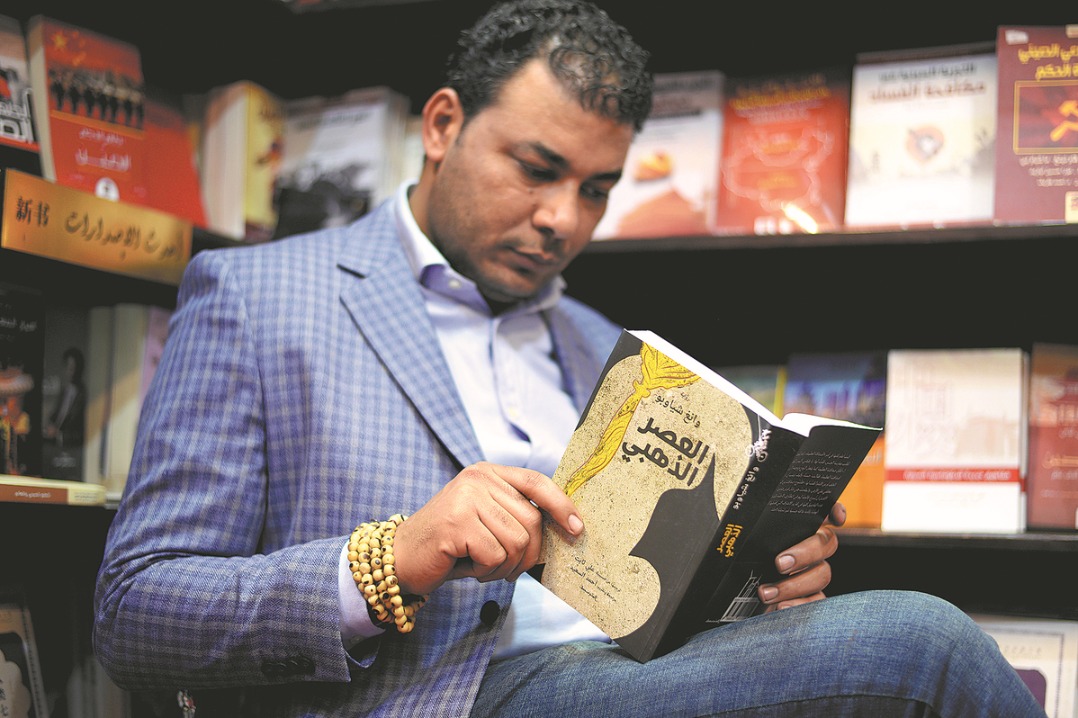

| CAI MENG/CHINA DAILY |

Launched by President Xi Jinping in September 2013, the Belt and Road Initiative is designed to improve global connectivity and physical infrastructure to better link China with the rest of Asia, and Europe, the Middle East and Africa. The initiative envisages the creation of multiple economic corridors under the Silk Road Economic Belt and the 21st Century Maritime Silk Road.

In the past four years, the Belt and Road Initiative has gradually gained traction with new projects and financing coming on stream, such as the flagship 418-kilometer rail link with Laos and the $46 billion China-Pakistan Economic Corridor, and the establishment of the Asian Infrastructure Investment Bank and the Silk Road Fund. While it's hard to quantify the total number of projects and amount of financing, the China Development Bank said it alone had reserved $890 billion for more than 900 projects in 2015, highlighting the magnitude of the undertaking.

Indeed, while new multilateral institutions such as the AIIB have started to play an active role in project financing, most of the funding for the initiative's projects is actually bilateral. In addition to that from the China Development Bank and the Export-Import Bank of China, we estimate that the "big-four" State-owned banks extended $90 billion loans to the economies along the initiative's two routes in 2016. Thus, bilateral financing from China's commercial and policy banks dwarfs multilateral financing and we expect that to remain the case in the future.

Nevertheless, even the combined annual bilateral and multilateral financing flows, including those from international multilateral institutions (such as the World Bank and Asian Development Bank) are modest compared to infrastructure spending and needs in the vast region covered by the initiative (the Asian Development Bank estimates the annual infrastructure investment needs at $1.7 trillion until 2030).

That said, the initiative-generated infrastructure will benefit some of the least developed parts of the world, and improved infrastructure should facilitate trade and investment, create new market demand and contribute to global development. While we estimate the region covered by the initiative will contribute 80 percent of global GDP growth by 2050, up from 68 percent in 2016, our fairly constructive projection of growth in the region is subject to downside risks, including those from global trade protectionism and, domestically, from supply side constraints, which, however, can be reduced by infrastructure development, and regional trade and investment collaboration.

Of course, China needs to make sure its engagement with other countries does not become unbalanced. Especially, it needs to ensure its manufacturing exports to the economies along the two routes do not crowd out domestic production and result in trade deficits that could lead to economic and/or political tensions. In fact, while the share of China's exports to the region covered by the initiative has grown steadily, from 23 percent in 2010 to 28 percent in 2016, the share of China's imports from the economies along the two routes has fallen in recent years (measured in US dollars)-partly because of the drop in commodity prices, though.

We expect Chinese construction companies to largely benefit from the initiative through new sources of demand abroad, but we don't expect it to have a major impact on mopping up excess capacity in China's heavy industry, because the annual demand for heavy industrial products in the initiative-generated projects will be small compared to the scale of overcapacity in China's heavy industries.

In conclusion, China has devoted significant amounts of political capital, energy and financial resources to the initiative, and it has made some notable progress over the past four years. And although the initiative's short-term macro impact is likely to be modest, if well managed, we expect it to support long-term growth and development in the economies involved. The initiative can also increase China's international influence by providing a platform for it to enhance its role in global financial governance, and eventually help the internationalization of the yuan by encouraging its use in both trade and financial transactions, albeit under the condition that China liberalizes its capital account.

The authors are economists with Oxford Economics.