GDP in US falls by highest rate since 1947

By SCOTT REEVES in New York | China Daily Global | Updated: 2020-07-31 09:59

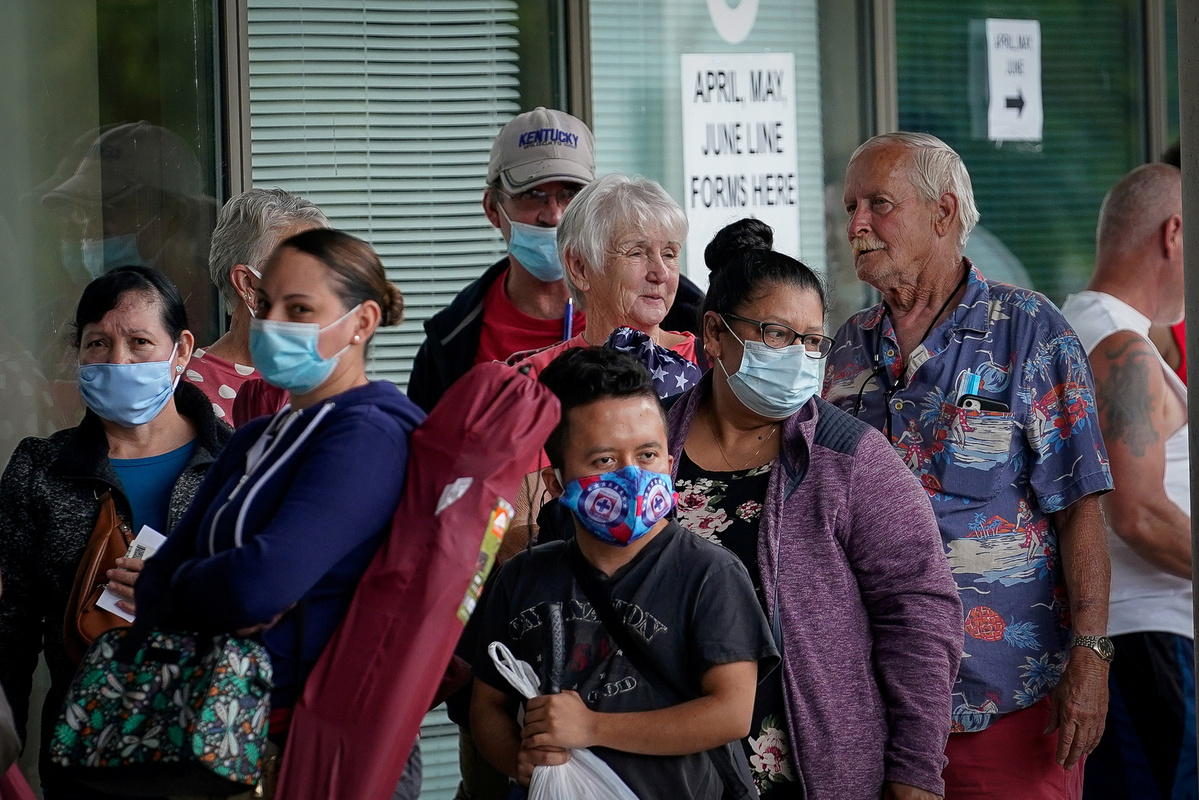

The US economy declined at a record pace in the second quarter and initial jobless claims rose for the second consecutive week as the coronavirus pandemic continued to crush the economy, government statistics released Thursday showed.

The gross domestic product fell at a 32.9 percent annualized rate in the second quarter and 9.5 percent compared with the same period a year ago — the sharpest decline for both tallies since 1947 when record-keeping began, the Commerce Department reported.

Initial jobless claims rose for the second week in a row amid an increase in coronavirus infections and new orders by governors to close the economy in some states, the US Labor Department said.

"The recovery will be slow as the lingering effects of COVID-19 severely limit growth," S&P Global said in a research report.

"We expect a modest rebound of 5.2 percent in 2021, a full percentage point weaker than our previous estimate of 6.2 percent."

First-time jobless claims for the week ending July 25 totaled 1.434 million.

Economists polled by Dow Jones expected initial claims to tick up to 1.45 million.

It was the 19th consecutive week initial unemployment claims totaled at least 1 million.

First-time jobless claims had declined for 15 consecutive weeks prior to the latest round of state-mandated lockdowns.

"We expect a slower drift down for the unemployment rate this year to 8.9 percent in the fourth quarter, almost one percentage point higher than in our April baseline forecast," S&P Global said in a research report. "The unemployment rate won't reach pre-crisis levels until fourth quarter 2023."

The downturn in economic activity is unlike any other in US history and has a basic cause: the government-ordered shutdown of the economy to contain the spread of the coronavirus.

Workers nationwide were directed to stay home from nonessential jobs, an order that sent the unemployment rate to a post-Depression high of 14.7 percent.

The unemployment rate for the week ended July 18 was 11.6 percent, a 0.5 percentage-point increase from the previous week's unrevised rate, the Labor Department said.

Continuing claims, or individuals receiving unemployment benefits for at least two consecutive weeks, increased by 867,000 to 17 million. The information is delayed by one week to allow statisticians to compile the numbers.

Continuing claims had been declining as the economy appeared to stabilize. An increase in the number of workers receiving benefits for an extended period could signal a weakening of the economy and raise fears of a further decline.

Data compiled by JPMorgan Chase showed that credit and debit-card transactions increased in May and early June but then remained generally flat through last week.

Consumer spending represents about two-thirds of the US economy.

The US Census Bureau's weekly Household Pulse Survey showed that 51.1 percent of households reported a loss of job income for the week ended July 21, up from 48.3 percent four weeks ago.

A 34.6 percent annualized decline in consumer spending underscored the second-quarter drop in GDP, the Commerce Department said.

Personal spending declined in clothing, footwear and at restaurants. Car dealers cut inventory and companies reduced spending on new equipment, the Commerce Department said.

On Wednesday, Boeing announced further production cuts and layoffs as airlines cut flights and demand for new aircraft collapsed during the pandemic.

Earlier this month, LinkedIn, owned by Microsoft, announced about 1,000 layoffs.

Inflation isn't an immediate threat. Prices for domestic purchases fell 1.5 percent in the second quarter, compared with a 1.4 percent increase in the first quarter when GDP contracted 5 percent, the Commerce Department said.

Excluding food and energy, the "core" personal consumption expenditures price index declined 1.1 percent.

Disposable personal income rose about 42 percent to $1.53 trillion. Most of the increase came from government transfer payments intended to assist workers during the coronavirus pandemic, the Commerce Department said.

Congress is debating the extension of an extra $600 a week in unemployment benefits. Democrats say the money is needed to help people with household expenses, but Republicans argue that the extra benefit discourages some from returning to work and therefore will slow the recovery.