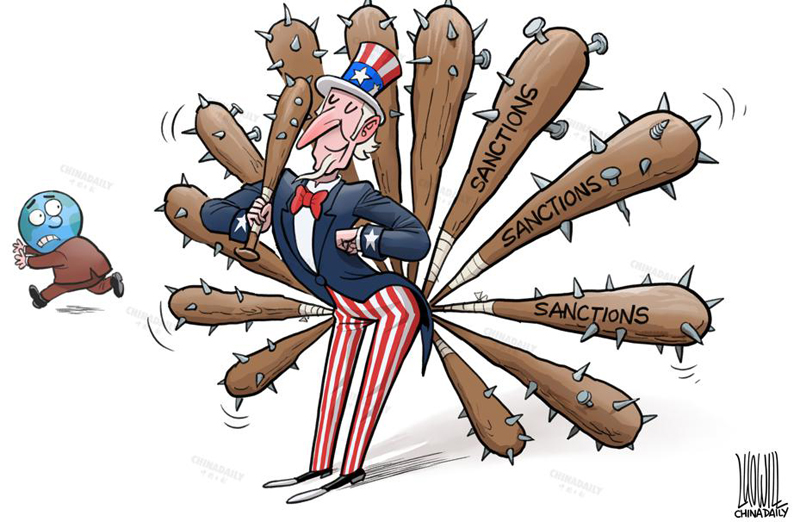

Western sanctions hit world economy

China Daily | Updated: 2022-04-29 07:04

Editor's Note: The Center for BRICS and Global Governance (CBGG), a Beijing-based nongovernmental think tank, organized a seminar on the global impact of Western sanctions against Russia and the international monetary system reform on Saturday. Following are excerpts from the speeches presented by three experts:

Sanctions should make world sit up

The financial sanctions against Russia could trigger a global credit crisis. Economic and financial globalization and the international monetary system are based on countries' credit ratings. If this foundation suffers a blow once again like the one suffered by the Bretton Woods system in the past, the international monetary system could face a deep crisis.

The severe sanctions against Russia include many against individuals, which among other things have invalidated their credit cards. Also, Western powers have frozen Russia's $300 billion foreign exchange reserves.

Indeed, the sanctions' impacts are being felt beyond Russia, with India asking that, if even the foreign exchange reserves of a country are unsafe, what will be the future of the international monetary system.

Apart from the possibility of more and more regional and international trade being conducted in local currencies, the efficiency of the global financial system will decline. The dividends produced by globalization, too, will shrink.

The financial sanctions against Russia are already shaking the existing international monetary and financial systems. That indicates a global credit crisis could break out and its impacts would be felt by all countries.

If developed countries take advantage of their strengths, break their promises at will, and shake the foundation of the global credit system, they may end up triggering a global financial storm. And in a globalized world, where all countries share not only the spoils but also the risks, the initiators will also be impacted by the storm.

Therefore, all countries need to move cautiously and think twice before doing something that could weaken the global financial system's foundation. Otherwise, all countries, including developed ones, will suffer.

Liu Shangxi, president of the Chinese Academy of Fiscal Sciences and an academic member of CBGG