Strong indicators trigger yuan float rumors

By Ding Qingfen (China Daily)

Updated: 2010-03-11 09:47

|

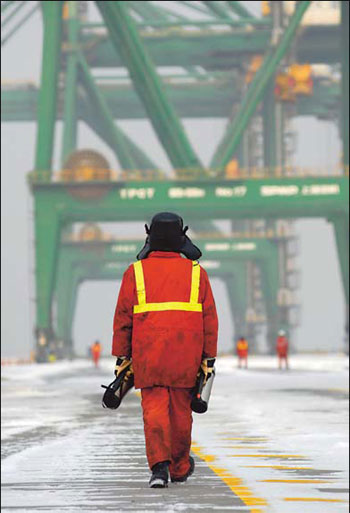

Workers at the Dongjiang Bonded Area in Tianjin. China's exports rose 45.7 percent year-on-year in February. Mai Tian / China Foto Press |

BEIJING - The stronger-than-expected 46 percent year-on-year growth in exports during February this year has sparked speculation that the nation may start revaluing the yuan later this month.

But some analysts have cautioned that not too much should be read into the strong numbers as the comparable base in 2008 was much lower. Political pressures are much more compelling reasons for the revaluation than market pressures, they said.

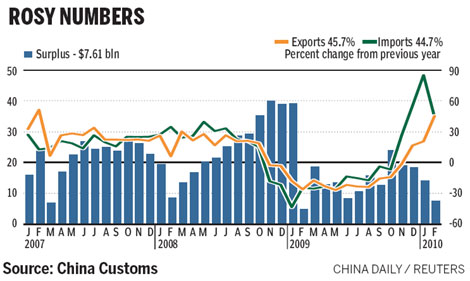

According to Customs figures, China's exports surged by 45.7 percent year-on-year to $94.5 billion, compared with 21 percent growth in January. The numbers are, however, much stronger than general market expectations.

Imports surged by 44.7 percent year-on-year to $86.9 billion in February, down from 85.5 percent growth in January.

"The strong export recovery is good news for those who want the yuan to appreciate," said Wang Tao, head of China Economic Research with UBS Securities. "We expect such moves to be gradual ones in the second quarter."

The yuan has remained largely unchanged against the dollar since the second half of 2008. The global financial crisis led to job losses and bankruptcies, and exports from the country languished for want of takers.

Central bank governor Zhou Xiaochuan recently said the dollar peg was a temporary response to the global financial crisis and would be changed "sooner or later", although he did not reveal any timetable. But his statements have triggered speculation that the yuan would be de-pegged soon.

Adding further credence to the rumors are the rosy export numbers and a forthcoming US Treasury report on whether China is manipulating its currency, analysts said.

"This is a real recovery (of exports and imports), with China's import recovery being V-shaped and export recovery U-shaped," said Stephen Green, head of research at Standard Chartered (China).

"It helps to reinforce market confidence that China will appreciate the yuan soon, probably as early as late March," he said.

In mid-April, the United States is likely to release a half-yearly report on whether China manipulates the yuan for trade advantages. "China has to make its moves before that, otherwise it is more or less certain that it would be labeled as a manipulator," Green said.

Zhu Baoliang, deputy director-general of the economic forecasting department of the State Information Center, however, said: "China will not succumb to pressure. Appreciation of the yuan is not something that can happen so fast."

Wu Xiaoling, former vice-governor of the central bank, said China's exports are cheaper due to low labor and resource costs rather than the manipulation of the yuan.

Moreover, since last November, China's trade surplus has begun to ease off and fell by half in the first two months of this year. The Ministry of Commerce has warned that the nation could have a trade deficit soon.

Meanwhile, China's non-official holding of dollar assets is also galloping, which technically reduces pressure on the yuan's appreciation against the greenback, according to Reuters.

Jim O'Neill, head of global economic research at Goldman Sachs, recently admitted that although he had accused China of manipulating currency in the past, the yuan's real exchange rate is now largely based on the purchasing power parity and is not undervalued.