Yearender: Predictions for 2016 through 20 questions

(China Daily) Updated: 2015-12-31 07:53

|

|

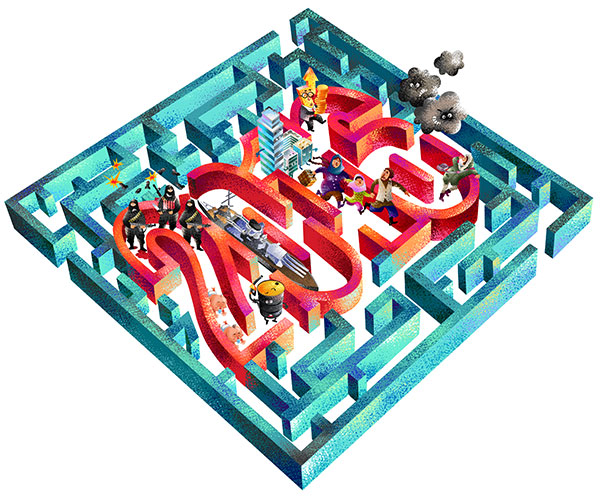

LI MIN/CHINA DAILY |

As a new year approaches, China Daily invited researchers and experts to share their thoughts on 20 major issues that are expected to have an impact in 2016.

|

|

Cao Heping |

1. Will the Chinese economic slowdown continue?

Cao Heping, a professor at the School of Economics, Peking University

Yes. Generally speaking, China's economic growth will slow down next year. But the Chinese economy will still maintain a sustainable growth rate. I expect China's GDP growth rate to be between 6.7 percent and 7.7 percent in 2016.

The traditional economy will see low speed growth, signaling a slowdown in economic growth. But the new economy could come up with a series of surprises, boosting growth. The new economy is the result of the transition from a manufacturing-based to a service-based economy.

For instance, the telecommunications and computer sectors have developed over the three decades since reform and opening-up. With the rapid development of the Internet, which has led to the technological revolution of "Internet Plus", the new economy could get a fresh shot in the arm. The achievements of the new economy in the short term may be more astonishing than the achievements of domestic Internet giants such as Baidu, Alibaba and Tencent in recent years.

In the future, I expect the new economy to overshadow the traditional economy.

|

|

Mei Xinyu |

2. Will China's inflation rate fall below 1 percent?

Mei Xinyu, senior researcher at the International Trade and Economic Cooperation Institute of the Ministry of Commerce

No. The year 2015 was the first time the inflation rates of the G7 countries were below 2 percent since 1932, and the inflation rate will remain comparatively low globally in 2016. China's overall inflation rate next year will be less than 2 percent. The low inflation rate in China this year was the result of a sharp decline in the prices of raw materials and energy. Since the prices are not likely to plummet further next year, China's inflation rate is not expected to fall below 1 percent.

Internationally, prices of raw material and energy will remain low for a long time. In 2015, global crude oil prices fell below $40 a barrel. And in 2016, Saudi Arabia may increase crude production because of domestic political reasons and Iran will return to the global crude market, increasing the production by 1 million barrels a day. Under such circumstances, crude prices could fall even further.

Also, the producer price index will continue to decline, which will have a negative impact on inflation.

According to my research, China's inflationary pressure has come mainly from the fast rise in labor cost in recent years. But next year the increase in the cost of domestic labor will slow down because of the economic downturn, which will further reduce the pressure of labor costs on inflation.

- Top 10 policy changes in China in 2015

- Yearender: Ten most talked-about newsmakers in 2015

- Yearender 2015: Chinese athletes of year

- Yearender: 2015 auctions overview

- Yearender: China and US in 2015 - moving forward together

- Yearender 2015: Key words from stories that created buzz in China

- Yearender 2015: Stories that made headlines

- Yearender: 2015 auctions overview

- Yearender 2015: Natural disasters

- Top planner targets 40% cut in PM2.5 for Beijing-Tianjin-Hebei cluster

- Yearender: Predictions for 2016 through 20 questions

- Clamping down to clean up the air

- Hotline links Taiwan and the mainland

- No new year's celebration in Shanghai one year after stampede

- Dictionary of Xi Jinping's new terms

- Freed death row inmate is compensated

- Shanghai airport going supersize

- Political bureau members should not feel superior: Xi

- Parents try to clear air for children at Beijing schools