China Life invests $300m in Visa offering

China Life Insurance Co, the nation's largest insurer, said it invested $300 million in Visa Inc's initial public offering, and plans further investments in the US and Europe to diversify its portfolio.

"We're also considering other IPO investments overseas, particularly in financial institutions since that's our home turf," Qu Jiahao, assistant general manager of China Life's investment management division, said yesterday.

Visa "is more of a financial investment for now. We're not looking at any strategic link-ups with Visa at the moment," Qu said.

China Life, with 925.2 billion yuan in assets, wants to put more of its money overseas to diversify risk after the mainland benchmark stock index fell 25 percent this year.

The insurer aims for strategic equity stakes to make up 5 to 10 percent of its portfolio, Chief Investment Officer Liu Lefei said in November.

"China Life's done very well with their contrarian play investing in a US IPO, given Visa's debut performance," said Howard Wang, who oversees $14 billion at JF Asset Management Ltd in Hong Kong.

"This was likely more an opportunistic financial investment to take advantage of Visa's IPO pricing. China Life weighed the Chinese market against overseas markets, and in the short term, the latter looks more attractive."

Visa, the world's largest payment-card network, raised more than $19 billion this month in its initial offering. Its share sale ranks as the largest US IPO and is second globally to the $22 billion debut by the Industrial and Commercial Bank of China in 2006.

The stock gained 28 percent on its March 19 trading debut.

The insurer made the investment, its biggest in the US stock market, using its own foreign-currency assets, Qu said.

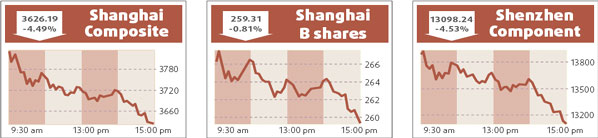

China Life's Shanghai-traded stock lost 8.15 percent to close at 28.97 yuan yesterday, the stock's lowest close since its January 2007 trading debut on the Shanghai bourses.

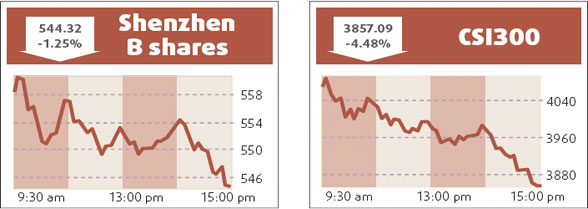

China's CSI 300 dropped 4.5 percent yesterday, while an index tracking financial stocks on the benchmark index pared 5.8 percent, the most of 10 industry indexes.

Ping An Insurance (Group) Co, China's second-biggest insurer, announced on March 19 it has agreed to pay $3.4 billion to buy half of Fortis' asset-management business.

Agencies

(China Daily 03/25/2008 page15)