Resilient cities to cushion realty's fall

By Fulong Wu (China Daily) Updated: 2012-01-11 08:07

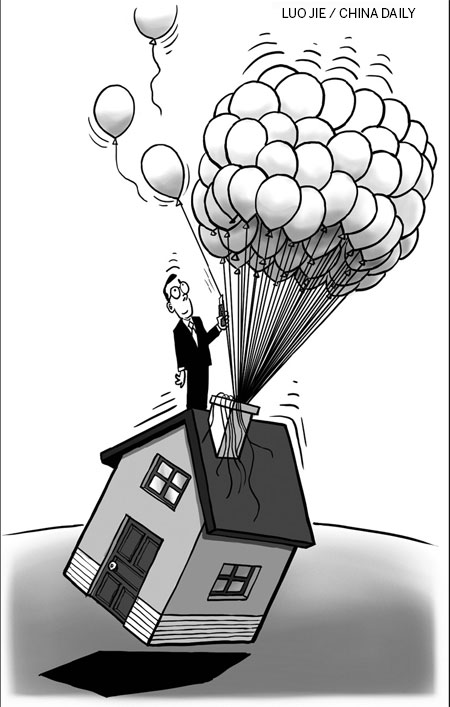

After two years of tightening policies, the flow of speculative investment into China's property sector began slowing down, and house sales and housing prices dropped in major cities. So it is quite natural to ask whether we are seeing the deflation of the housing bubble.

Pessimistic forecasters predict an imminent collapse of China's housing market. But such a scenario is not likely, for Chinese cities may be more resilient than they are thought to be.

From this year, housing prices will drop by 10-20 percent, rather than 50 percent. The adjustment would lead to a healthier housing market and avoid a hard landing for the economy.

There are several reasons for such cautious optimism. First, China is still undergoing fast-paced urbanization. The populations of major cities have been increasing rapidly in the last decade, and the demand for housing is robust.

Second, the downturn in the housing market is the result of regulative control and correction of the boom, during which an excessive amount of money was pumped into infrastructure that subsequently flowed into the property market to prevent a decline in manufacturing jobs, rising rate of unemployment and consequent social unrest. But if necessary, the policy control can be adjusted in response to changing circumstances.

Third, the lack of alternative investment opportunities pushed up property prices over the past years. Investment outlets may remain uncertain for some time and the property sector is less fluid than the financial market, so a swift retreat from property investment is more difficult.

Fourth, despite the sluggish domestic demand and uncertainties in the global economy, China's economy remains competitive, and its fiscal capacity and foreign exchange reserves mean it still has a quite large room to maneuver.

The reasons for cautious optimism also mean the lure to speculate in the property market remains. So regulations to deter speculation in the property market should continue.

During the housing market boom, those who climbed the property ladder enjoyed windfall profits from investing in the real estate sector, and the hope of ever-rising property prices convinced them to become extraordinarily adventurous in buying a second and even a third property.

But local governments-led "growth machine" of land was the ultimate driver of the property market boom. Such a growth model inflated the property bubble forcing the economy to over-rely on investment and export.

The declining housing market may reduce the land revenue of the local governments and affect other sectors such as cement and steel production, construction and domestic appliance making. But now four local governments have been authorized to issue government bonds to cover their fiscal deficit, which it will help delink land sales from local revenue.

The transformation of the economic growth model in the background of a slowdown in exports means investments into infrastructure have become less incentive. Hence, local governments should no longer focus on large-scale infrastructure projects. Also, the cooling down of the property market may slow down the growth of the migrant population, but Chinese society is remarkably resilient, because the hardworking laborers are more adept at adapting to harsh living conditions and more willing to take up difficult jobs. They make up the genuine consumer market, too.

At this stage, the authorities should maintain the tight regulations to prevent the return of speculators into the property market. The lesson of pumping excessive capital into one sector to maintain (or increase) the employment rate should be learnt, because ultimately the expansionist approach could be more risky, because the bursting of the housing bubble will be more disastrous for society in the long run.

To allow a soft-landing, the government needs to change its "business model". It should not rely on investments into infrastructure and the property market as economic growth stimulator. Providing affordable houses for low-income people is a priority, but that does not mean the government should be the only provider. For one, the standard of affordable housing could be even more modest. Urban elites may consider self-built houses in "urban villages" as eyesore , but the fact remains that they provide shelter for many migrant families.

The provision of "affordable housing", like high-rise commodity housing, may not be affordable in the long run. In contrast, the demand in the lower housing market during urbanization will remain robust.

Therefore, it is absolutely unnecessary to demolish "urban villages" to make space for large-scale property development. Such an approach could even be economically unviable in the future. Local governments should avoid aiming at instant transformation of the urban landscape. A more flexible approach would be to allow self-improvement and modest accommodation in "urban villages".

The government needs to focus more on the provision of basic infrastructure and services such as road improvement. These investments may not be immediately profitable but they could be made viable through collection of property tax for service delivery.

Overall, persistent and gradual adjustment should be preferable. Besides, such a scenario is any day preferable to the bursting of the housing bubble, because resilient cities cushion realty's fall.

The author is Bartlett professor of planning at the University College London.

(China Daily 01/11/2012 page9)