Rising wages reach a milestone

Last year's slowdown, triggered in part by government policy measures to cool the domestic housing market and exacerbated by Europe's economic crisis, caused China's economic growth to slump to 7.7 percent - the lowest in more than a decade. We expect growth to accelerate to about 8.3 percent this year.

Wage increases are partly government-driven. China's 12th Five Year Plan (2011-15) aims to raise the national minimum wage by an average of at least 13 percent each year, faster than in previous years. Local authorities are free to set their wages above the national level. In fact, provinces have increased minimum wages by an average of 16 percent this year, following a 20 percent increase last year.

Shenzhen in the PRD region tops the list in terms of minimum wages, with minimum monthly pay of 1,600 yuan ($258). This has forced more than half the companies in our survey to raise wages more than they had planned to, particularly for their least skilled workforce.

As salaries rise, only the fittest will survive. Naturally, larger companies are better able to compete by investing more in technology and securing larger, longer-term orders from overseas customers. Three out of five companies surveyed said they are responding with bigger investments in machinery. They are also investing in process automation tools, outsourcing or partially sub-contracting production, boosting in-house design functions, and hiring employment agencies to find new workers.

Moving production to cheaper locations is also an option, but a costly one. And such decisions are not driven purely by labor cost considerations. Relocation means losing proximity to suppliers and customers, dealing with new tax and regulatory regimes, and bearing higher transport costs. That said, our survey suggests that companies are increasingly willing to consider moving out of the PRD region or expanding to new locations.

About 30 percent of the companies surveyed said they planned to move factories inland, while 10 percent said they would move out of China altogether. Both figures are more than double that of last year's. Within China, many companies in the PRD region want to move westward to the Guangxi Zhuang autonomous region, where wages are 30 percent lower. Other popular destinations include Jiangsu, Hunan, Hubei and Jiangxi provinces. The favoured overseas destinations are Cambodia, Bangladesh and Vietnam.

Labor shortage has long been a challenge in the PRD region. But manufacturing wage trends of the past few years in the region reflect the nationwide situation because the labor market is highly mobile. A squeeze on the surplus labor pool in the Delta leads to rising inland wages and pushes up real wages for migrants leaving agriculture jobs.

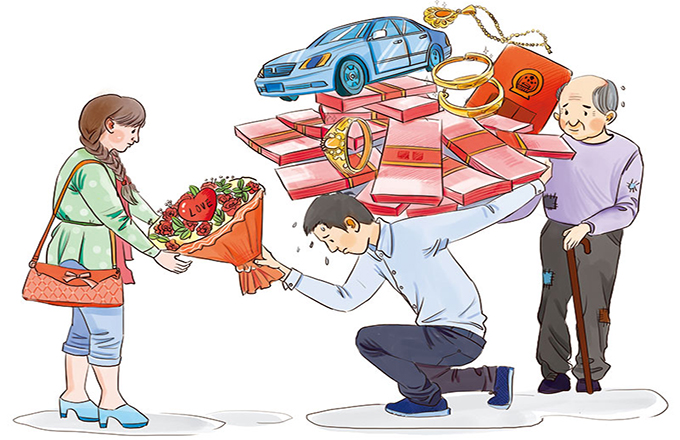

There is also a new element fuelling the wage spiral - China's aging workforce. The number of people aged between 15 and 59 years fell by 3.45 million in 2012, the first absolute decrease in the labor force since the late 1970s. Add this ingredient to the mix, and it's easy to see why the Lewis Turning Point has arrived in China a few years earlier than many had anticipated.

Kelvin Lau is senior economist and Stephen Green is head of Greater China Research at Standard Chartered Bank.

(China Daily 05/06/2013 page9)