Emerging market prospects

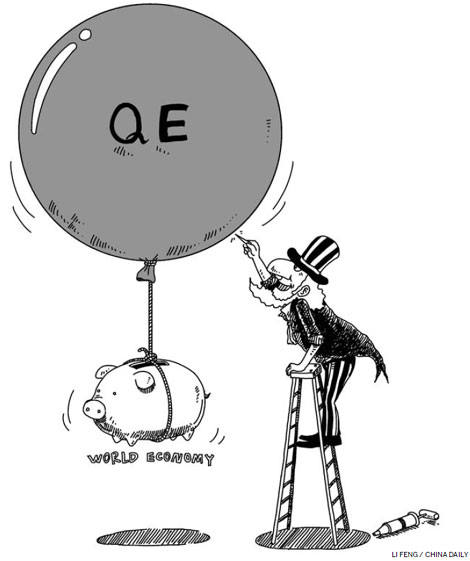

By Louis Kuijs (China Daily) Updated: 2013-09-06 07:05Where do we go from here? We cannot rule out further turbulence in the financial market. Emerging Asian economies have stronger macro fundamentals now and are better prepared for capital outflows than they were during earlier crises. In addition to stronger current account positions, debt service indicators are substantially less intimidating. Exchange rates are also more flexible now and central banks have larger foreign currency reserves.

However, the prospect of reduction in global liquidity and higher interest rates could still lead to further corrections in portfolios, and financial markets are prone to overreact and overshoot.

What should Asian policymakers do to best manage the shift to tougher global monetary conditions and mitigate the impact? They would do better to limit the size of current account deficits and keep the macroeconomic position sustainable, basically by avoiding expansionary macro policies. Growth remains the key, but it should be stimulated by growth- and productivity-enhancing structural reforms, not by expansionary policies.

As to the entry of foreign capital, in principle, there is nothing wrong with it. However, foreign capital that flows into a country because of its growth potential poses less risk than capital that rushes in to reap short-term financial gain. This means it pays to remain open to and attract foreign direct investment by maintaining a good investment climate.

Governments should also work to reassure markets of long-term stability. On the other hand, it is best not to rely too much on financial capital inflows, which could well call for introduction of sensible forms of capital controls at times. Indeed, for China, this episode underscores the need for exercising caution when it comes to financial reform and opening up the capital account.

Finally, what could the region do in terms of mutual financial assistance? The past decade saw the rollout of many bilateral swap lines and other arrangements. During the global financial crisis of 2008-09 they were not used as often as they should have. Therefore, it would be useful to ensure the existing arrangements are used in times of need and make room for more such arrangements.

The author is an economist with Royal Bank

of Scotland.

(China Daily 09/06/2013 page9)