Cost of economic restructuring

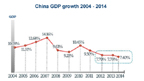

By Xin Zhiming (China Daily) Updated: 2014-10-11 07:50As restructuring is set to be a drag on the economy - at least temporarily - the real estate price corrections, which will affect a number of related industries, will also add to the downside pressure for the economy. The local government debt pile-up, if not resolved, could pose new financial uncertainties. Worse, the fragile global economic recovery has failed to generate strong growth for China's exports.

Those unfavorable conditions have prompted many economists and government officials alike to urge the authorities to take new stimulus measures to prevent the economy from diving. But central policymakers have rightly put forward the idea of adapting to a "new normal", a phrase that virtually rules out the possibility of returning to the old stimulus-based growth pattern even if growth temporarily slows.

Instead, the authorities have made more efforts to push systematic reforms to lay the groundwork for future growth. For example, the administrative approval power has been streamlined to facilitate doing business and some monopoly sectors, such as oil, have been opened to non-State investors. Meanwhile, policymakers have taken measures to restructure the economy by curbing shadow banking and tackling excess capacity, high energy demand and high pollution.

Along with such reform and restructuring measures is the country's raised tolerance toward lower economic growth. Premier Li Keqiang said on Wednesday that although China has set its GDP growth target at 7.5 percent this year, it does not mean it's the bottom line. It does not matter if it turns out to be slightly lower than 7.5 percent, the premier told ministers at a State Council meeting.

Such a down-to-earth attitude no doubt is crucial for China to continue to carry out its reform agenda and push economic restructuring to unleash the growth potential of the economy in the middle term. If China cannot face up to the current economic difficulties and resist the temptation of a quick stimulus-driven economic pick-up, it will only cost the economy growth opportunities in the coming decade.

Policymakers, of course, are well aware of the pros and cons of those options. But they cannot afford a sharp economic slowdown, either. Facing the weak economic data in the third quarter, they may have to temporarily loosen their purse strings to keep a hold on the growth rate.

To what extent the policymakers will re-open the capital tap, therefore, will become crucial in deciding China's development track in the next phase. It will also become a barometer for observing China's resolve in implementing its reform and restructuring agenda.

The author is a senior writer with China Daily. xinzhiming@chinadaily.com.cn