More forceful steps likely needed to keep foreign exchange reserves stable

|

|

Financial capital flows.[Photo provided to chinadaily.com.cn] |

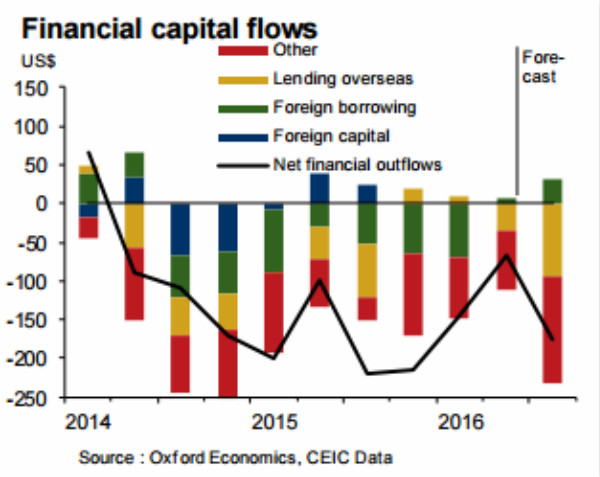

The People’s Bank of China spent $778 billion over the past two years to control the pace of the yuan's depreciation against the greenback, depleting foreign exchange reserves and raising concerns over the sustainability of that policy.

We expect the authorities to continue their policy of managing the pace of depreciation against a globally strengthening US dollars and containing financial outflows in 2017. They will likely decide that letting the yuan slide significantly would lead to a loss of confidence in the currency and an unfavorable reception in Washington DC.

But the existing policies may not be enough. More contentious measures such as formally re-imposing restrictions on outflows or re-introducing rules on the sale of US dollars receipts by exporters have so far been avoided. But to achieve stable foreign exchange reserves, we estimate that net financial capital outflows will eventually have to fall around $450 billion on an annual basis, compared to the level in 2016.

Considering the size and composition of outflows, our forecast and China’s policymakers’ trade-offs (between a currency slide and heavy-handed measures), we conclude that they may eventually resort to these more forceful steps.

While such steps are damaging to the reputation of China’s reform program and the internationalization of the RMB, we think that policymakers will consider that it is a price worth paying and will result in less long-term reputation damage than the alternative of a significant depreciation under pressure from outflows.

The author is the Hong Kong-based head of Asia economics for Oxford Economics.