Housing Provident Fund no longer serves its intended role

|

|

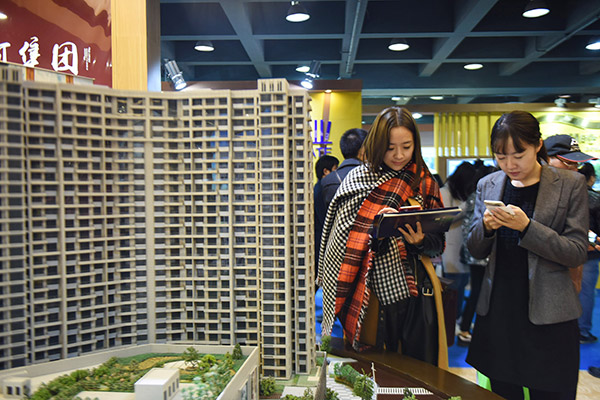

A potential homebuyer checks out a property project in Hangzhou, Zhejiang province, Dec 17, 2016. [Asianewsphoto by Long Wei] |

IN SHANGHAI, just 30 percent of those applying to the Housing Provident Fund for low-interest loans are low-income employees, while the percentage of middle-income applicants is much higher. Beijing Youth Daily commented on Wednesday:

That more people with middle-incomes rather than low-incomes are applying to the Housing Provident Fund for loans to purchase an apartment seems to go against the design of the fund.

The government introduced the Housing Provident Fund in Shanghai in 1991, requiring all employees of State-owned enterprises to contribute a proportion of their salaries to the fund with employers contributing a similar amount. Workers are allowed to withdraw their savings from the fund when they retire, alternatively they can use the money to purchase homes in the private housing market. They can also apply for low-interest loans from the fund to buy property.

Now the use of the fund is basically confined to home buying, with the majority of those applying for low-interest loans from the fund being middle-income homebuyers.

This situation is difficult to change. On the one hand, the local housing provident fund management authorities have loosened the limit on low-interest loans several times to help more urban employees with their down payments. On the other hand, with governments increasing the amount of down payment required as a measure to rein in housing prices, more low-income households can hardly make the monthly repayments on a loan.

In Shanghai first-time homebuyers have to pay down payments of at least 35 percent and those aiming at a second property 50 percent, while buyers of commercial properties need to pay 70 percent. It is basically the same case in other megacities, where the low-interest loan offered by the housing provident fund schemes can barely cover the down payment of most homes on sale.

That is why fewer low-income families apply for loans from the fund while more affluent homebuyers, who do not necessarily require extra financial support, are doing so. The trend, which has been noted in a 2015 report issued by the Ministry of Housing and Urban-Rural Development, warrants fresh actions to assist prospective low-income homebuyers.