E-town brews internet finance

When Alibaba launched Yuebao, few people expected that so many similar products would ensue. Tencent and Jingdong both rolled out similar internet finance products, and Shenzhen and Tianjin both launched internet finance action plans.Now Beijing Economic-Technological Development Area, or E-town, will use internet finance to build a finance demonstration zone.

Internet finance has blossomed in E-town, said an official with the town’s development and reform bureau.

Internet finance brings changes

Internet finance has not only changed people’s lives but also influenced enterprises, becoming a new financing channel for small and micro businesses. Last year, Jingdong built an e-bank to help suppliers satisfy their needs and solve problems in fund flow.

"Simply moving financial products to internet platforms is not internet finance in a real sense," said Huang Zhen, a research scholar. The significance of internet to the finance industry is to use a network approach to bring down costs of financial services and improve efficiency and service coverage.

Internet finance can break geographic restrictions and help more people enjoy convenient service, said Liu Changhong, head of Jingdong’s finance and capital business department. At the same time, the biggest changes are efficient service, costs reduction and lowered financial thresholds.

Water testing in E-town

E-commerce leader Jingdong began internet finance exploration at almost the same time as Alibaba.

“We came up with supply chain finance at the beginning of 2012,” Liu said. In fact, Jingdong begun finance business quite early. It just didn’t decide whether finance business should be separate from others.

The finance department became independent in July 2013 and was divided into e-banking, consumer finances, and platform business.

E-bank was built in a payment company acquired by Jingdong. Jingdong’s supply chain finance aims to serve the financing needs of suppliers, and consumer finance targets individual financing needs. Platform business refers to online sales and promotions of products from other financial institutes.

Liu said that future finance products will involve the whole trade chain of suppliers. Jingdong also launched consumer finance for individuals, as well as products similar to Yuebao.

In addition to Jingdong, E-town Capital is also developing internet finance products. The inclusive financial service will bring benefits to small and micro businesses in E-town.

What does E-town have to offer internet finance development?

The town is at the core of information technology development and has gathered the leaders in internet, big data and cloud computing, which will offer solid technical support. At the same time, the town is one of the first 34 national e-commerce demonstration facilities and home to nearly 1,000 e-commerce enterprises . It witnessed nearly 40-50 billion yuan of transactions in people's livelihood service, supply chain trade and farmer-supermarket interactions.

More importantly, the town has also attracted many financial institutes, including nearly 30 banks, seven securities and futures institutes, as well as small loan and bonding companies. It has developed a service system led by business loans and complemented by bonds, equity investment, bonding, funds, insurance and listing services.

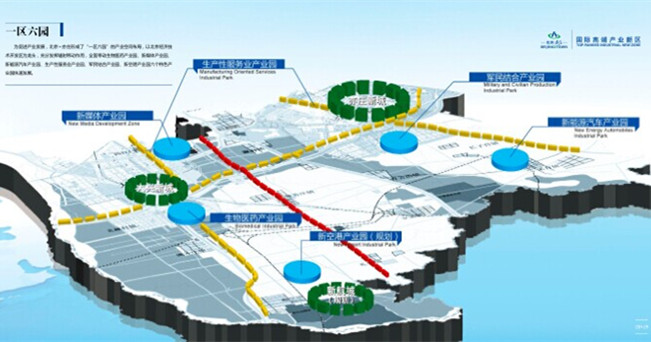

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500