Insurance at a premium as firms face risks alone

By Xie Yu (China Daily) Updated: 2012-03-07 07:38Avoiding the market

China Life Insurance, the country's largest State-owned insurance group, offers only one package for enterprises with workers abroad. It will cover groups of no fewer than 50 people and the payout sum is 200,000 yuan per person.

However, applications for projects in high-risk zones such as in Iraq or Sudan are routinely rejected. The same goes for China Pacific Insurance.

It is an "unwritten rule" that insurance companies do not offer life coverage for individuals in "dangerous, unstable regions or war zones", said Yi Si, a senior account manager at New China Life Insurance, a share-holding firm.

"Profits of insurance companies depend on probability. By evaluating quantitative data, we make sure we can make money," she said, explaining that there is no reliable analysis for employees on overseas projects.

"Meanwhile, the domestic market is already too large for us to fully develop. Why would we take the risk (on workers abroad)?"

It is even harder to get property overseas insured, Yi added, because it is difficult for underwriters to judge the value.

"The problem is there's no reliable organization in China that can support insurance companies to analyze the risks in different regions," said Wei at the China Center for International Economic Exchanges. "So instead, they choose simply not to enter the market."

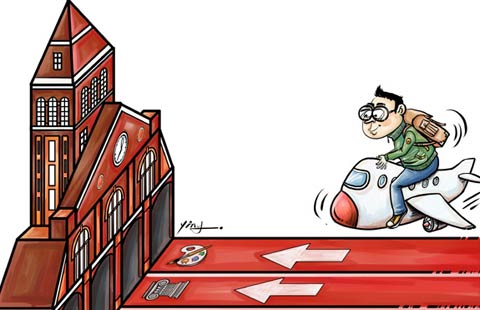

The central government encourages State-owned enterprises with operations abroad to set up a service center that will offer plans for life, property and investment insurance.

In the meantime, as insurance firms are unwilling to handle the overseas expansion, he said authorities should encourage enterprises to get employees and assets covered by foreign insurers.

Yet, it is not a popular solution. Many Chinese bosses have raised concerns about communication, especially when it comes to submitting claims.

"We would still choose a domestic insurance company, even if it charged a much higher premium (than a foreign firm)," HR manager Zang said. "If they don't provide certain packages, then we'll just have to bear the risk ourselves."

- Seven villagers murdered in N China

- China steps up tobacco control efforts

- Five jailed for separatism in Xinjiang

- Letter asks for leniency in poisoning case

- Antibiotics in surface water pose 'indirect health risk'

- Tianjin airport opens up transit link to Beijing

- High levels of antibiotics in China's major rivers

- China to dig tunnel for Asian rail system

- Bering strait line to US possible, experts say

- China: Stop oil rig harassment