A lot on the plate

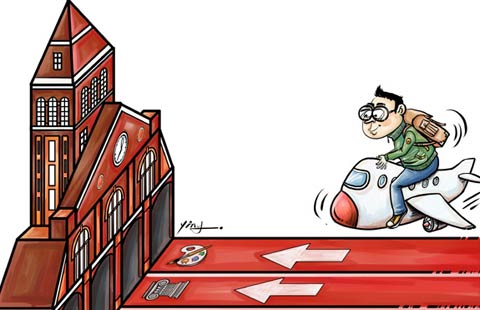

By Lu Chang (China Daily) Updated: 2012-03-31 07:54But of late, there has been considerable speculation in the international trade community that China's inability to feed itself may have long-term consequences on the global food system. Some experts have even predicted that increased imports may lead to global food shortage and hunger.

Minister of Agriculture Han Changfu had earlier remarked that China's grain imports are primarily to enrich crop varieties in the domestic market, and he stressed that the nation "will not and cannot" rely on imports to feed its 1.3 billion population.

China feeds more than 20 percent of the world's population despite having less than 10 percent of the world's agricultural land and less than 6 percent of the water resources. The government has reiterated that it intends to meet about 95 percent of its food requirements from domestic sources.

Li said China accounts for a very small share of the global grain imports, and hence hardly in a position to shape global grain market trends, and least of all hunger in some less developed countries.

"It is actually a win-win situation rather than some evidence of a faltering agricultural sector," he said.

"On the one hand, increasing agricultural imports will help China ease pressure on natural resources and increase the country's grain security," Li said. "But at the same time, the growing demand for farm food consumption also creates opportunities for international food manufacturers, as the unit prices increase in tandem with consumption patterns."

Hogging the limelight

Pork imports have already hit the nadir and there seems to be no letup in demand, considering that domestic supplies are likely to remain constrained for some time.

"The gap between supply and demand is bound to increase within the next few years, despite an expected recovery from diseases and the reduction of small-scale pork farmers," said Wang Xiaoyue, a senior analyst at Beijing Orient Agribusiness Consultant Ltd.

"China's pork imports will continue to rise due to strong demand and competitive pricing on imports," he said.

The sharp decline in pork production last year led to record imports. China's imports of pork and pork offal reached 1.35 million tons, up 50 percent over 2010, with the US being the largest exporter, accounting for more than half of the total volume, according to the General Administration of Customs.

At the same time, China has also become a top lure for meat exporters as demand has been climbing steadily. Most of the major pork exporting nations from Europe, North and South America are knocking on China's doors.

China's imports of pork and pork offal reached their peak in 2008 with a volume of 910,000 tons. In 2010, the country imported 900,000 tons of pork, with Denmark being the major supplier, followed by the United States, Canada and France.

"As a country develops economically, the first quality of life aspect that improves at the household level is the carbohydrate to protein ratio on the daily diet. Greater economic prosperity among consumers on the mainland has directly translated into higher shares of animal protein such as pork," said Jorge Sanchez, director of agricultural trade office at the US consulate in Guangzhou.

"An increase in pork consumption creates opportunities for US pork farmers, because the unit price increases are fueled by consumer demand."

Ma Chuang, deputy secretary-general of the China Animal Agriculture Association, said that the country's surging demand for pork and pork offal implies an optimal export scenario because Chinese consumers tend to place higher value on pork offal, which is not eaten in Western countries. As a result, overseas farmers can profit considerably from pork offal exports.

Pork imports stood at 467,000 tons last year, and pork offal stood at 882,200 tons. Pork offal such as pig's heads, knuckles and haslet (a form of meatloaf), accounted for 65 percent of the total volume.

Not just tofu

Soybean imports by China are expected to maintain an uptrend in the next 10 to 15 years with growth being driven primarily by the demand from urban residents.

"Soybean imports are expected to grow substantially in the long term propelled by growing demand for oil and livestock feed," said Ma Wenfeng, a senior analyst at Beijing Orient Agribusiness Consultant, a major agricultural consultancy.

According to a US Department of Agriculture forecast, China's imports of soybean are expected to go up by 62 percent to 90 million tons over the next 10 years.

"Soymeal, produced in China largely from imported soybeans, is an integral protein component of the feed necessary to support China's burgeoning pork, poultry and aquaculture industries," said the US Department of Agriculture in its first forecast 2012-13.

"Their rapidly maturing animal husbandry and feed industries, including aquaculture, expansion in crushing capacity and growing consumption of vegetable oils, are all driving demand which cannot be met by domestic supplies."

In recent years, each person in China has been consuming 5 percent more meat, 10 percent more milk, and 8 percent more cooking oil annually compared with five years ago, according to the National Bureau of Statistics.

China is the largest importer of US soybeans, and buys a quarter of the country's soybean production. In February, when Vice-President Xi Jinping made a visit to the US, a Chinese trade delegation signed a deal to buy US soybeans with a total value of $4.31 billion and volume of 8.62 million tons.

The nation became a dominant force in the international soy markets in the late 1990s and is now the world's largest importer and consumer, taking in 55 million tons in 2010, more than 50 percent of the annual global trade. Total soybean consumption has risen 64 percent since 2005, but the self-sufficiency rate stands at about 20 percent, according to Customs.

Ma said it is more efficient for China to import soybeans than to produce them, as soybean production needs more land and water supplies.

"China will be more susceptible to price fluctuations in the international food market with more soybean imports," he said. "But during unfavorable weather conditions, the soybean imports will keep the country insulated from international speculation and food-price fluctuations in the global market."

- Seven villagers murdered in N China

- China steps up tobacco control efforts

- Five jailed for separatism in Xinjiang

- Letter asks for leniency in poisoning case

- Antibiotics in surface water pose 'indirect health risk'

- Tianjin airport opens up transit link to Beijing

- High levels of antibiotics in China's major rivers

- China to dig tunnel for Asian rail system

- Bering strait line to US possible, experts say

- China: Stop oil rig harassment