Online world of opportunity

By Shen Jingting in New Delhi and Chen Limin in Beijing (China Daily) Updated: 2012-05-08 06:53Competition at home

|

|

Small Internet start-ups are highly vulnerable to the rapidly changing environment in China. Richard Ji, managing director at Morgan Stanley Asia, pointed out that the average life span for Chinese Internet companies is three to five years, much shorter than in many other countries.

One solution to this limited life span is for Internet companies to explore opportunities abroad instead of fighting in the fiercely competitive home market, especially as the country's Internet giants, such as Tencent and Alibaba, have not yet made major moves overseas, leaving some openings for Chinese start-ups.

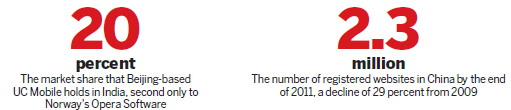

UC Mobile also plans to enter the North American market in the first half of this year, by setting up an office in California's Silicon Valley and launching localized products. However, it's just one of a number of Chinese Internet companies that have jumped on the bandwagon to snap up business opportunities overseas.

NetQin Mobile, a mobile security company listed on the New York Stock Exchange, said overseas business currently accounts for almost 45 percent of its total revenue. That figure is likely to rise to more than 50 percent by the end of the year, according to Henry Lin, the chairman and CEO.

The US has become the company's fastest-growing overseas market since it hired its first local employee in 2009. More than 5 million people use its products in the US, ranking NetQin among the top five providers in the market, according to statistics. "We expect to gain the top spot in the US smartphone security market in less than three years," Lin told China Daily in an exclusive interview in September.

Meanwhile, Hainan Tianya Online Network Tech Co, the operator of one of China's best-known online forums, Tianya.cn, set up two overseas branches last year, one in Silicon Valley and the other in Singapore, to attract users and advertising clients from Southeast Asia and North America. Twenty percent of Tianya's traffic originated overseas last year, according to CEO Xing Ming.

Overseas adventure

These companies are following in the wake of the online games industry, which started its overseas adventure in 2003 and has seen a large number of players expand. In 2011, 34 Chinese providers of online games generated combined revenue of $360 million, up 56.5 percent from a year earlier, according to the General Administration of Press and Publication, the industry regulator.

"The main advantages for Chinese companies when expanding overseas are that they have engineering resources and a large domestic market where they can roll out products. Plus, they are well capitalized and have cash," said Duncan Clark, chairman of the investment consultancy BDA China.

"Just China's sheer weight and scale will provide companies with some advantages when developing products," he added. However, he pointed out that Chinese companies are still in the initial stages of overseas expansion and the percentage of overseas sales is still low.

Major obstacles

Cultural challenges, limited experience in international operations and a shortage of talent have been the major obstacles to achieving the desired result, said Clark. "Western perceptions, such as issues over censorship or privacy, are going to be difficult for them to overcome," he said. "And more important, I think it's just an HR challenge - do they have the people who can operate well internationally and can they communicate well with foreigners?"

The story of Baidu hints at the problems some companies have experienced when attempting to expand overseas. Despite being the biggest search engine in China, Baidu has failed to replicate that success in foreign markets.

Back in 2009, Robin Li, the chairman and CEO, said the company aimed to take a dominant position in the Asian search market by 2012, echoing Google's dominance in the West. However, the company's first and biggest move - into the Japanese market - has yet to yield much fruit. In 2008, a branch was opened in Japan as the company launched its search service in the country. Yet, the website ranks only around 900th among Japanese websites in terms of traffic, while Google's search service has the second-highest volume, according to the traffic tracker Alexa.com.

"Both Baidu and Google are competing in an overseas field, and the one that provides better services and knows the users better will win," said Hong Bo, a Beijing-based IT critic who follows the Internet search sector, adding that Baidu has failed to come up with a unique service to differentiate itself from rivals.

"The branding of Chinese Internet companies is also weaker, compared with their foreign counterparts," said Hong. Even Tencent and Baidu, the two biggest Internet companies in China, lack strong branding outside their home country, he added.

However, the relative failure in Japan hasn't seen Baidu slow its pace in overseas expansion, is preparing to set up an office in Brazil and launched its services in Thai, Vietnamese, and Arabic last year.

Hong argued that it's difficult to replicate domestic success in the search and e-commerce sectors overseas, because both require a large user base and a high number of user hits. Games and utilities may provide an easier ride, he said.

BDA China's Clark, agreed. "I think things such as technical aspects and utility make good sense. If you can develop a simple but very effective tool, I think Chinese companies will do well in that. (And in) games and other items, potentially. But in e-commerce and other things, you face challenges in terms of payment."

Morgan Stanley's Ji suggested that Chinese Internet companies should focus primarily on their home market and only look overseas when conditions are conducive. "I don't say that Chinese Internet companies cannot expand overseas, but I hope they can do it in a selective and systematic manner. I don't think any company can be a global champion if it performs poorly in its home market.

"The priority (for Chinese Internet companies) is still to win the battle in the domestic market," he added. Although the growth rate of China's Internet market is predicted to decline to 10 percent this year from 40 percent previously, there is still plenty of room for growth, he said.

Contact the reporters at shenjingting@chinadaily.com.cn or chenlimin@chinadaily.com.cn

- Seven villagers murdered in N China

- China steps up tobacco control efforts

- Five jailed for separatism in Xinjiang

- Letter asks for leniency in poisoning case

- Antibiotics in surface water pose 'indirect health risk'

- Tianjin airport opens up transit link to Beijing

- High levels of antibiotics in China's major rivers

- China to dig tunnel for Asian rail system

- Bering strait line to US possible, experts say

- China: Stop oil rig harassment