Liquor makers on a high as profits heady

Holiday season to see rising investments globally and new varieties of products in white-hot market, the world's largest

Fat profits are encouraging distillers of baijiu, a Chinese white spirit distilled from fermented sorghum, to continue their investments in the sector, ahead of the busy sales season spanning Christmas and the Chinese Spring Festival in the second half of January.

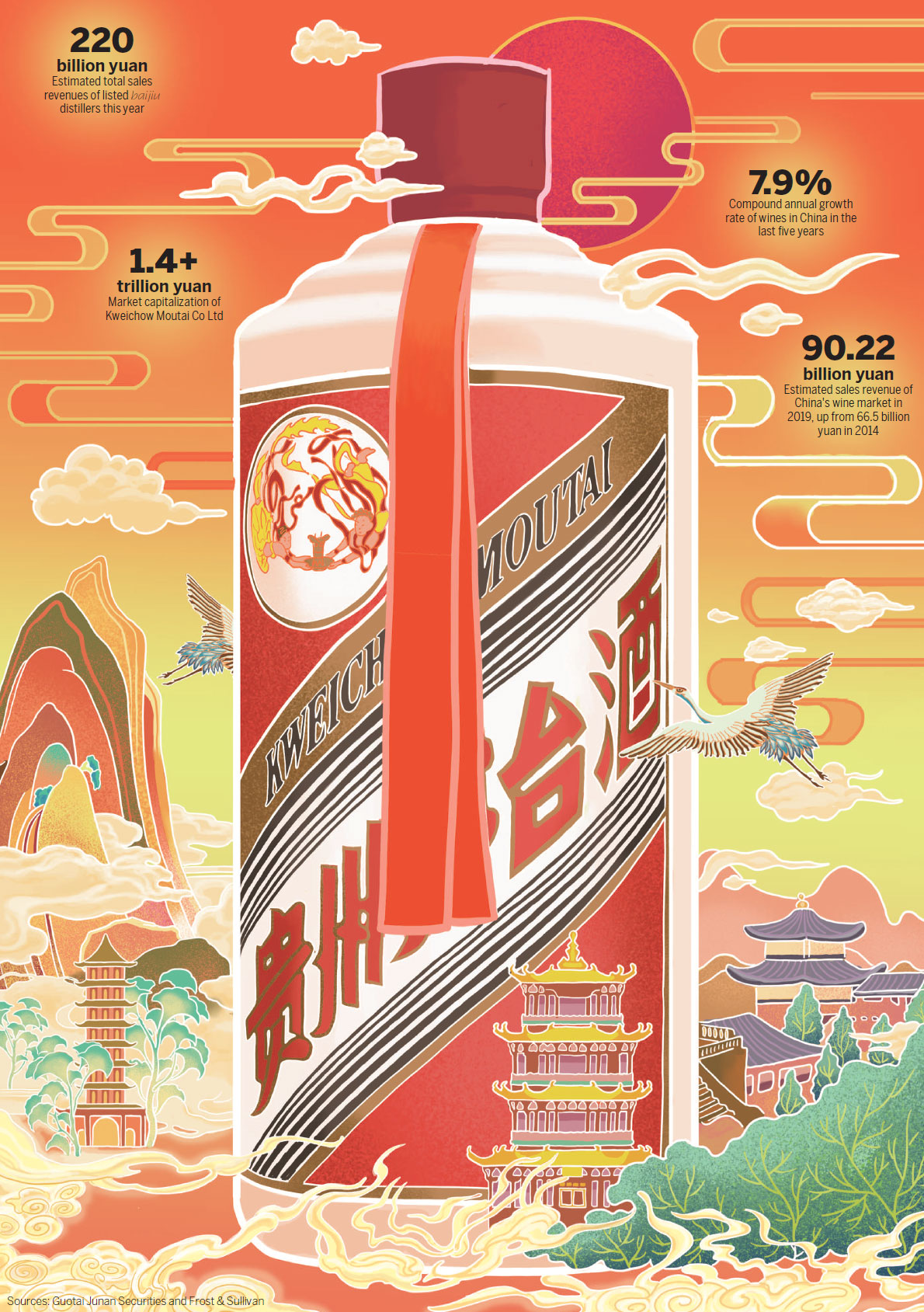

Baijiu is the most competitive consumer goods in China. This year, listed companies that make baijiu are expected to achieve total sales revenues of more than 220 billion yuan ($31.4 billion), according to Guotai Junan Securities.

Kweichow Moutai Co Ltd, an iconic baijiu distiller from Maotai town in Southwest China's Guizhou province, said it will establish its own e-commerce platform next year and further promote overseas sales of its products.

"We will speed up the research and development of new products based on market demand, and optimize the market layout and our distribution networks," said Li Baofang, president of Kweichow Moutai.

"Next year, we will provide more specific sales guidelines for our dealers nationwide, and continue to reform our sales and marketing system. The company will be committed to regulating and standardizing the market environment effectively."

Li said Moutai products are in short supply in the overseas market this year, and the demand-supply gap is widening, suggesting that Moutai has become very popular abroad.

This year, Moutai sales started in overseas markets such as Chile, Argentina, Peru, Tanzania, Kenya and Ethiopia. In addition, sales continued in major overseas markets such as the United States, Russia, Germany, Italy and Australia.

Next year, Kweichow Moutai would further expand its overseas footprint, especially in the countries and regions involved in the Belt and Road Initiative, the company said. A promotional push is likely in Dubai. To brighten its brand image, it also plans sponsorship of corporate events at home and overseas, like the China Daily-hosted Vision China series of public talks and discussions.

Moutai products, which have often been in tight supply because of strong demand, have sparked speculative transactions in the China market. On some e-commerce platforms, buyers had to reserve products in advance and complete purchases as soon as the products became available, to avoid a potential out-of-stock situation.

The Shanghai-listed company's market capitalization exceeded 1.4 trillion yuan this year. In June, it became the first stock to see its share price exceed 1,000 yuan after 27 years. It also became the most expensive stock in the A-share market, boosted by continuously growing consumer demand for the company's products and good corporate earnings.

"Baijiu embodies Chinese culture in a sense. It boasts distinguished core competitiveness. Foreign companies are hard to compete with Chinese liquor makers in this regard," said Zi Meng, managing director of Guotai Junan Securities.

"The net profit margin of high-end baijiu makers can exceed 40 percent, higher than the 35-percent gross profit margin of most consumer products. In the future, baijiu distillers may grow further using their strong brand image, popular products and efficient sales channels."

Meanwhile, a number of major middle-end and high-end baijiu distillers in China have raised their product prices. Earlier this year, higher-end spirit makers such as Sichuan-based Wuliangye Yibin Co Ltd and Luzhou Laojiao Group raised their prices.

In early November, baijiu maker Sichuan-based Shuijingfang Liquor Industry Co Ltd announced it would raise the prices of four of its higher-end products. The price of one variety of 500-ml baijiu bottle rose 60 yuan to 1,039 yuan. For three other varieties, prices rose 20 yuan per bottle, according to the company.

"With the hot sales season of Spring Festival fast approaching, many people will buy baijiu for family and business banquets. So, some white spirit makers aim to burnish their brand image by raising prices," said Cai Xuefei, a white spirit industry analyst.

Zi of Guotai Junan Securities said there is a growing trend of people investing in high-end liquors to compile vast personal collections. Liquor bottles as collectibles has become a fad. High-income consumers are not price-sensitive, leading to a continuous rise in prices of high-end baijiu products.

On the other hand, sales of wines, a newcomer in the array of alcoholic drinks in China, have been surging in the past few years, prompted by a growing demand from young consumers who would like to pursue healthy and trendy lifestyles.

China has eight major wine producing areas, including Xinjiang Uygur autonomous region, Ningxia Hui autonomous region and Gansu province. Red grape varieties make up about 80 percent of the total wine market in China, and white wines take the rest.

In the past two years, both the number of online wine buyers and sales grew at an annual rate of 40 percent. Supermarkets and liquor stores still remain the major distribution channels for wines, according to data from consultancy Frost& Sullivan.

Wine consumers aged between 18 and 35 accounted for more than 80 percent of the total, and the proportion of youngsters joining the wine consumption group has been rising, it found.

In the past five years, wine sales in China grew from 66.5 billion yuan to 90.22 billion yuan, at a compound annual growth rate of 7.9 percent, buoyed by the increasing recognition of wines by Chinese consumers. In the next five years, with the wine-drinking culture expected to become even more popular, sales will continue to grow steadily, said Frost& Sullivan.

"Last year, the global average consumption ratio of spirits and wines was equal, while in China, the proportion was about 7:1. The annual consumption volume of wines per capita in China is less than 1.5 liters, while the corresponding number in the United States has exceeded 10 liters," said Neil Wang, president of Frost & Sullivan's China unit.

To tap the significant growth potential, especially among young consumers, more and more domestic wine producers are focusing on adjusting their product structures. They have introduced more wine varieties in smaller (200 ml or 375 ml) bottles.

"Besides, with demand for high-quality and differentiated products growing, the advantages of local and distinctive small-scale production areas have become more prominent. Wines made from small-scale and niche production areas are gradually recognized and favored by an increasing number of Chinese consumers," Wang said.