China's economy still much better than West

Editor's note: In the face of increasing uncertainty in the external environment and given the arduous task of achieving low-carbon, green development, China has to overcome some serious challenges this year to further revive its economy. And while doing so, it should accord priority to promoting sustainable economic growth and making breakthroughs in advanced technology. Three experts share their views on the issue with China Daily.

The global economy has not been performing at its full potential, especially since the subprime mortgage crisis of 2008, which started in the United States and spilled over the banking system of most of the developed Western economies, evolving into the global financial crisis. And before the global economy had recovered, it faced the COVID-19-induced recession, the trade wars initiated by the US government, the near collapse of supply chains, the Russia-Ukraine conflict, and the ensuing economic sanctions, all of which have slowed the rates of growth of almost all economies.

Through a combination of expansionary monetary and fiscal policies, the US has been able to reduce unemployment and keep a healthy rate of growth during the past two years. But as a result, inflation increased, which forced the authorities to raise interest rates, thereby placing a brake on GDP growth. According to the Organisation for Economic Co-operation and Development, this is expected to reach just a dismal 1.5 percent in 2024, lower than the projected 2.4 percent in 2023.

In 2024, the other large Western economies are going to fare even worse. Japan's GDP growth is expected to be 1 percent, while Germany, France, the United Kingdom and Italy will all grow at even lower rates. In fact, the average for the OECD nations will be just 1.4 percent.

In the case of China, the OECD has forecast a 4.7 percent growth rate for 2024. This is lower than the 10 percent-plus growth rates reached by China until 2010, but still higher than the rate forecast for the other large economies and the 2.4 percent predicted for the world economy.

The Chinese economy's extraordinary dynamism may be lackluster because of the convergence of structural with conjunctural problems. There might be a problem of diminishing returns of capital. China after reform and opening-up facilitated very high rates of private and public capital accumulation.

However, even after most of the unemployed and underemployed workers were incorporated into the economy (the main factor that explains the lifting of massive numbers of people out of poverty), capital accumulation continued at impressive rates. With fewer workers available the labor-capital ratio started to fall and consequently the economy started to endure diminishing returns on capital and slower GDP growth.

Part of this fast rate of capital accumulation is the reason behind the over-investment in housing and office space that has led to one of the conjunctural issues that are hurting the economy at present. These cycles are not unusual in market economies. For the most part, China is a market economy substantially integrated into the world value chains. Therefore, it is also vulnerable to the economic cycle of the Western economies. The difference is that China's pragmatism allows for a more intensive use of countercyclical intervention policies to correct market imperfections.

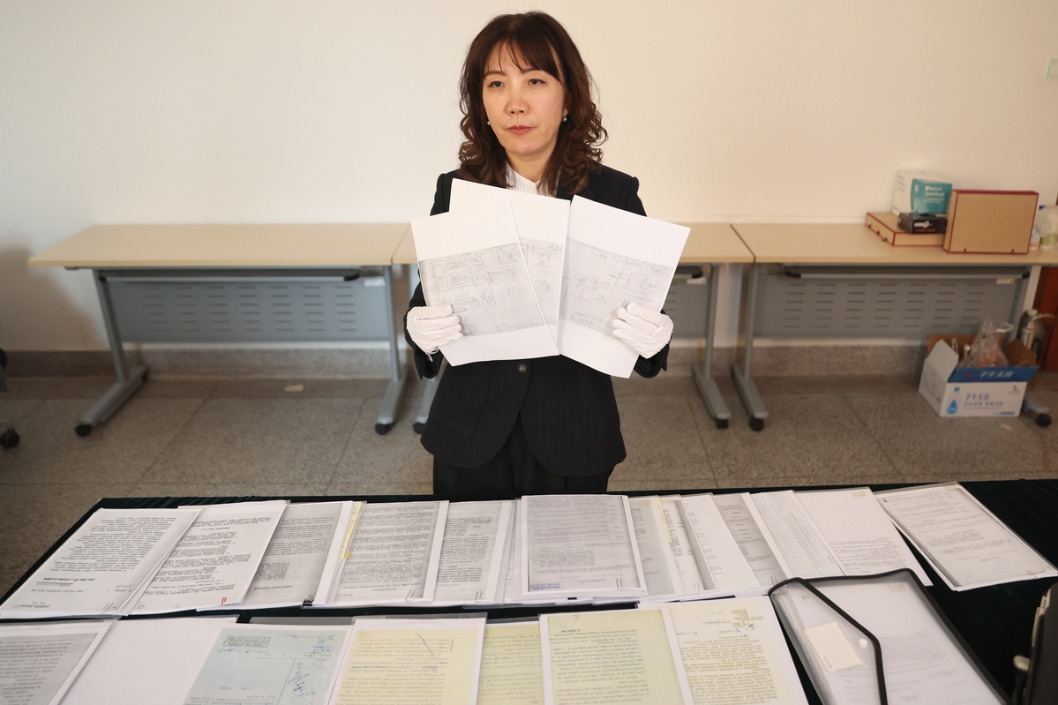

The current crisis in part of the real estate sector is similar to what happened in the financial sector of the US in 2023 when several banks (among them, Silicon Valley Bank, Silvergate Bank, First Republic Bank and Signature Bank) went bankrupt causing fears of an economic meltdown.

In spite of the constant attacks from Western politicians and opinion pundits toward the economic authorities of China because of their willingness to use government policies to control the economy, no sooner had the bank crisis occurred that the US government stepped in with the Federal Reserve Funding Program to rescue some of the banks and, more importantly, to prevent a wider contagion that could place the economy in stretches. Far from letting the invisible hand of the market to run the show, the crisis was overcome with the visible hand of the government playing a critical role.

The Chinese government could use sufficient financial leverage to acquire the debts and the assets (unsold building space) of the real estate giants at discount prices and to sell that empty space at low prices to houseless families and small businesses. In this way, the balance sheets of the creditor banks would be cleared, thereby avoiding a financial crisis and economy-wide negative effects, while real estate ownership would be further democratized.

The sole possible obstacle for the adoption of such a policy is the weight that the real estate bankrupt (and possible corrupt) corporations might have in government circles. However, if past behaviour is a good guide, under the central leadership that likely weight won't play any role.

There are other reasons for China to be optimistic. Protectionism might have peaked given the negative consequences that it has had on the performance of the US and other Western countries without undermining the Chinese trade balance. On the other hand, given the late opening of the Chinese tourist market, a lot will be gained by just recovering the pre-COVID-19 tourist levels. Hence, this year could see a boom in the hospitality business.

In short, there are ways to overcome current anxieties and to retake the Chinese path of fast economic growth, low unemployment and social mobility in 2024.

The author is a professor at Instituto Empresarial University in Spain, a senior fellow at Beijing Club for International Dialogue, and a former special advisor to the president of Costa Rica.

The views don't necessarily reflect those of China Daily.