Hydrogen electrolyzers latest star export item

Sales propelled by booming demand for sustainable growth in EU, Mideast

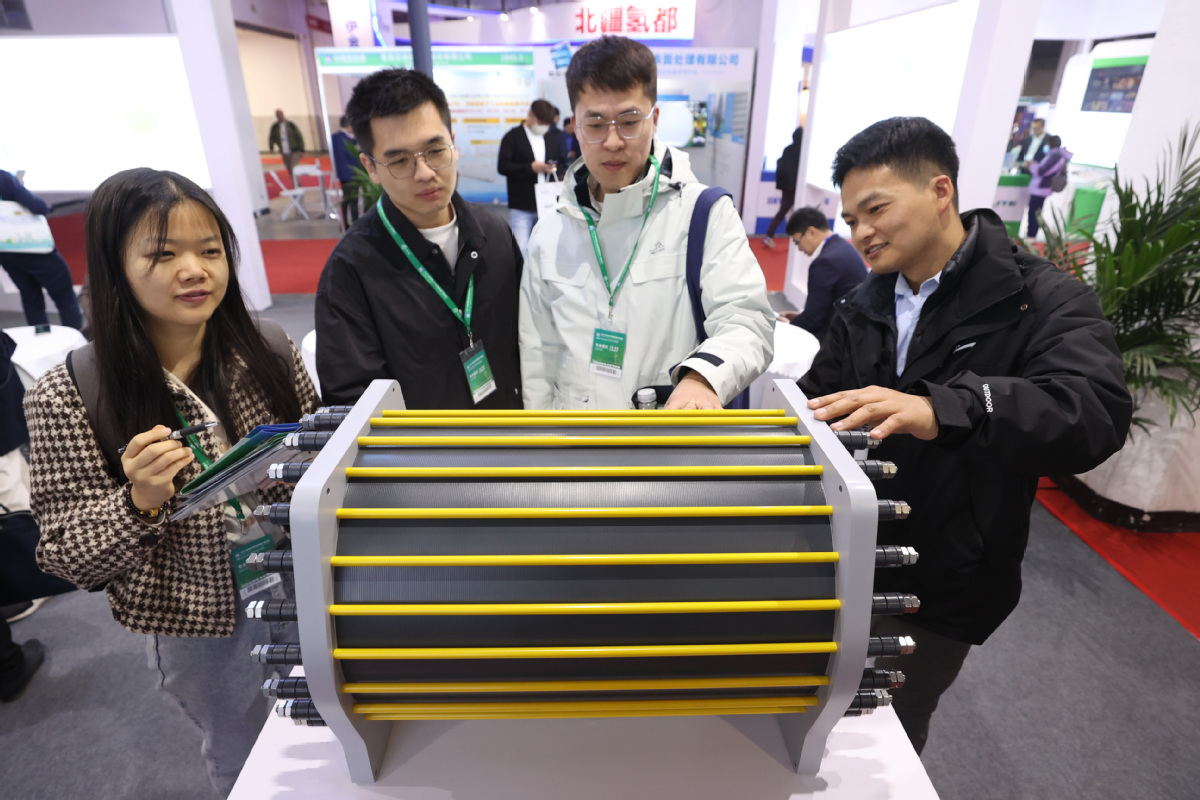

China, celebrated for its strides in sectors such as electric vehicles, lithium-ion batteries and photovoltaic technologies, is now on the brink of embracing yet another major potential export product in the realm of new energy products — hydrogen electrolyzers.

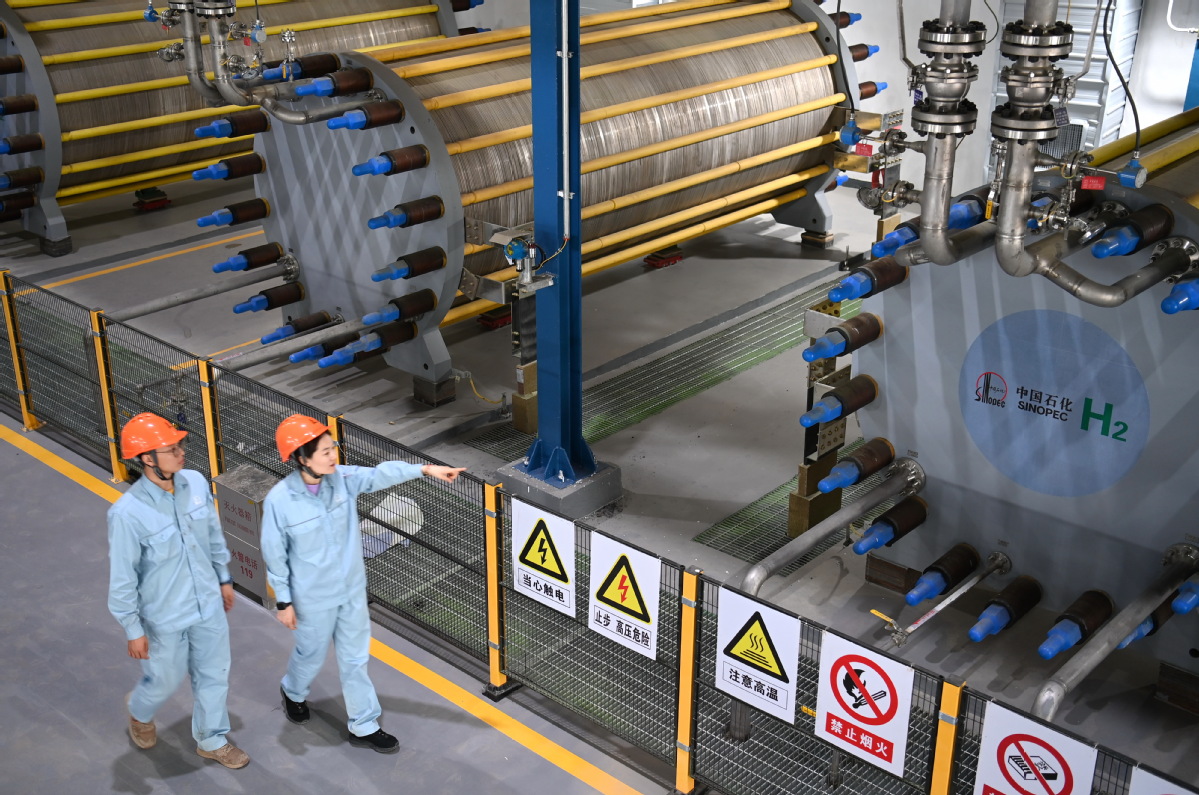

Hydrogen electrolyzers use electricity to split water into hydrogen and oxygen. For decades, the hydrogen electrolyzer, a technology entrenched in China's industrial landscape, primarily served domestic sectors like glassmaking and steel, with only limited export orders.

However, as the global appetite for green hydrogen escalates, a transformative shift is underway. Chinese hydrogen electrolyzer exports are experiencing an unprecedented surge, propelled by booming demand for sustainable solutions in Europe and the Middle East, catapulting this once niche equipment onto the international stage, executives and analysts said.

Beijing Peric Hydrogen Technologies Co, a manufacturer of hydrogen electrolyzers, has seen its export revenue double for three consecutive years due to surging global demand, said Li Haipeng, the company's marketing director.

The company's export value of hydrogen electrolyzers reached approximately 70 million yuan ($9.8 million) in 2021, followed by a surge to around 170 million yuan in 2022 and a further jump to nearly 300 million yuan in 2023, Li said, adding that over the next 10 years, order volumes are expected to be over 10 times current levels.

Shandong Saikesaisi Hydrogen Energy Co expects its overseas revenue to overtake domestic performance by the end of this year. Looking beyond the immediate horizon, a bold prediction emerges as a potential reality — a growth surge of several magnitudes in the entire foreign market following a five-year development period.

Rewind the clock two decades and it would have been hard to imagine the vibrant export situation that China's hydrogen electrolyzer industry now commands, Li said, as the international market size was only around 500-600 million yuan back then.

The explosive growth in China's hydrogen electrolyzer exports can be traced back to the recent surge in global demand for green hydrogen, according to industry experts.

The International Energy Agency recently said that amid pathways to realizing net-zero emissions by 2050, global hydrogen demand is projected to climb to 528 million metric tons by the middle of the century.

In particular, the report said that around 60 percent of this hydrogen will be produced through water electrolysis, accounting for nearly 20 percent of the world's total electricity supply.

As countries and industries increasingly seek to decarbonize their operations, the need for high-performance, cost-effective hydrogen production solutions has skyrocketed — and China's electrolyzer manufacturers have been quick to capitalize on this global trend, said Yu Zhuoping, director of the expert committee for China Hydrogen Alliance.

To accommodate more overseas orders, Chinese electrolyzer manufacturers are proactively scaling up their production capabilities.

Li said the company has seen a remarkable increase in its production capacity, growing from just a few dozen units several years ago to approximately 350 units last year. Notably, its production in the first half had already doubled compared to the same period last year.

The company's production capacity will surpass 1,000 units next year, with at least 50 percent of that output earmarked for export, Li added.

Sinohydo, a company providing hydrogen production and storage solutions in Jiangsu province, is set to accelerate its production capacity in North China, focusing on the Inner Mongolia autonomous region's Ordos. Meanwhile, the company plans to develop and upgrade its facilities in the Yangtze River Delta.

In addition to domestic efforts, Sinohydo is actively pursuing strategic partnerships in Europe, the Middle East and Japan.

Despite different resource profiles, the objective is to tap into growing demand in Europe and the Middle East, according to company executives.

Hydrogen applications worldwide are moving beyond the demonstration phase into large-scale implementation, particularly in Europe and the Middle East. The development of renewable energy hydrogen projects is driving a significant shift in demand for hydrogen production equipment, said Chen Xuedong, an academician at the Chinese Academy of Engineering.

The European Commission, the executive arm of the European Union, rolled out its EU Hydrogen Strategy in 2020, setting ambitious targets that rely on the installation of at least 6 gigawatts of renewable hydrogen electrolyzers in the bloc by 2024, and aims to produce up to 1 million tons of renewable hydrogen.

In addition, hydrogen needs to become an intrinsic part of an integrated energy system with the objective of installing at least 40 GW of renewable hydrogen electrolyzers by 2030 and producing of up to 10 million tons of renewable hydrogen in the EU.

Drawing parallels with China's largest-scale photovoltaic-based green hydrogen plant in Kuqa, Xinjiang Uygur autonomous region — where 20,000 tons are produced annually, requiring hydrogen electrolyzer usage — the EU's vision dwarfs existing benchmarks, said Du Jiaen, deputy general manager for overseas markets of Sinohydo.

The EU's target of producing 1 million tons of green hydrogen annually equates to the output of 50 Xinjiang Kuqa projects. In essence, achieving this target would necessitate the deployment of 2,600 hydrogen electrolyzers, Du said.

The need for over 2,000 electrolyzers in Europe presents a significant challenge for Chinese companies, which, even with continuous 24-hour production, cannot meet the demand on time. This gap means a substantial opportunity for Chinese suppliers to expand their market presence in the region, Du added.

Moreover, as the Middle East accelerates its shift toward greener energy solutions, the region is also emerging as a lucrative market for Chinese businesses.

The Middle East, despite being a major oil-producing region, has long recognized the urgency of energy transition, said Chen of the Chinese Academy of Engineering.

While the region has an abundance of photovoltaic power plants since its average annual sunshine is nearly twice that of China, it faces significant challenges in power consumption and grid integration, Chen said.

As a result, Middle Eastern countries are looking to produce green hydrogen and agricultural-use ammonia using low-cost electricity, leveraging their strategic location to export these resources to high-demand markets like Europe, Chen added.

As Chinese companies seek to expand their products beyond the domestic market, obtaining the necessary certifications and complying with international standards have become crucial prerequisites for success, industry insiders said, emphasizing that product certification is a major bottleneck facing Chinese enterprises in their globalization efforts.

The sheer diversity of standards and regulations in different countries and regions is truly staggering. The product certification process, which is essential for market access, is frequently accompanied by exorbitant costs, complex procedures and lengthy timelines, Du said.

Moreover, the electrolyzer is not a standalone device. It operates in conjunction with back-end separation and purification units to create a comprehensive hydrogen production system. This symbiotic relationship needs the back-end equipment to potentially undergo redesigns to align with specific customer needs, Du added.

Even in the face of considerable difficulties, it is remarkable to witness the unwavering enthusiasm and readiness exhibited by a multitude of manufacturers, Du said.