Medium- and high-end department store operator Parkson Retail Group Ltd has temporarily closed one of its Beijing stores following two closures elsewhere in the country, adding to a chorus of doubts being voiced about the challenged retail format.

The temporary closure by Parkson China - the first foreign-invested retailer in the country, opening in Beijing in the early 1990s - is of its store on the East Fourth Ring Road in the capital city.

Earlier this year, it closed a store in Jinan, Shandong province, as well as one in Changzhou, Jiangsu province.

Sam Au, chief financial officer of Parkson Retail Group, said the Beijing store is being closed for remodeling and that it will reopen at a later date. He did not give a timetable for the reopening.

Two other recently opened Parkson stores in Beijing have been the subject of negative comments because of their inconvenient locations, which have not been successful in attracting shoppers.

At midday Wednesday, the first floor of the Parkson store in the Taiyanggong area of the North Third Ring seemed to have no more than five shoppers in sight, while several employees of high-end cosmetic brands were seen to be either chatting or simultaneously vying for scarce customers.

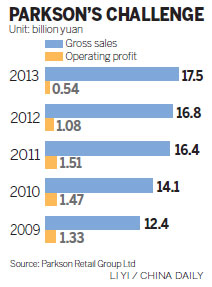

In 2013, same-store sales declined marginally by 1.8 percent year-on-year, which was attributed to weakened sentiment on discretionary spending, as well as the government's austerity drive, according to the company's financial report.

Given Parkson's intensifying competition, increasing number of new stores and stores with lower margin performance, profit from the group's operations declined by 49.7 percent to 543.4 million yuan ($87.5 million), the report said.

Last year, Parkson closed a store in Shijiazhuang, Hebei province, and terminated the contract of a store in Guizhou province, despite an expansion strategy that opened six new stores. The group operates and manages 58 stores in 37 major cities in China.

Though its number of stores grew by 20 percent year-on-year, Parkson was ranked just out of the top 10 department stores in the country, in 11th place, according to a report released by the China Chain Store & Franchise Association.

Last year, the top 50 department store operators in China saw their revenue grow by an average 9.6 percent, with store numbers increasing by 0.4 percent.

As Chinese shoppers' behavior has grown more sophisticated, the department store format has come under competition from malls and online retailers, said Wang Hongtao, director of the communication department of the CCFA.

China's department stores urgently need to adapt to the changing domestic retail market if they are to survive, a report from CBRE China Research said on Tuesday.

Contact the writers at wangzhuoqiong@chinadaily.com.cn and huyuanyuan@chinadaily.com.cn