Firm expects to zoom past Xiaomi in sales with better looks, pricing

The crowded smartphone market in China is about to add another heavyweight player with industry experts anticipating further price wars among the key players.

Internet magnate Zhou Hongyi threw his hat into the smartphone ring on Wednesday and promised fans "exquisitely made" handsets that will surpass Xiaomi Corp both in quality and price.

"I understand (selling smartphones in China) is a red ocean market, actually it is an ocean full of blood," Zhou said. The red ocean is used to describe a market packed with players and one in which profit margins are wafer-thin.

"But I am entering the market anyway because I believe there is no market that cannot be overturned and the leaders will not be always on top," Zhou said.

The 45-year-old, who headed Yahoo China in the early 2000s, drove out Internet security firms that charge customers royalties by introducing free-of-charge anti-virus software products about a decade ago. Zhou's Qihoo 360 Technology Co Ltd accounts for the lion's share of the for-private-use free online security market.

His smartphone firm, named Qiku, is a joint venture with Coolpad Group Ltd, a major contract smartphone maker in China. The new brand will unveil three types of handsets running a tailored Android operating system as soon as next month.

"Our device will easily sell at 5,000 yuan ($800) on the market, but we will offer buyers a remarkably lower price," Zhou said, without giving details of the products.

The three handsets will each target low-, mid-and high-end markets with the lowest price tag at around 1,000 yuan, a Qiku employee familiar with the pricing strategy told China Daily.

Local handset vendors opt to lower prices in the highly competitive smartphone market to grab bigger market share, industry sources said.

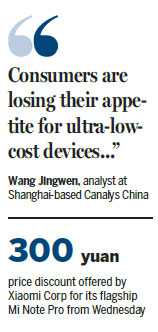

Hours before Zhou announced the launch of the affordable devices, Xiaomi said it will lower the price of its flagship device Mi Note Pro by 300 yuan.

At a rival show put on by the Beijing-based mobile firm, Xiaomi co-founder Lei Jun gave out free devices to reporters and said he has been trying to lower the price of the high-end Mi Note to maintain the company's lead in terms of market share. The original price for the device was 3,299 yuan.

Lei also indicated that Xiaomi's next focus will be in India and other emerging markets where the competition is not as fierce and no one wants a price war.

Wang Jingwen, a Shanghai-based analyst at Canalys China, said major Chinese vendors are facing the strongest headwinds in their home market since the smartphone boom began in 2011.

Wang said lower price is no longer the main criterion for Chinese smartphone buyers as customers have started to focus on user experience.

"Consumers are losing their appetite for ultra-low-cost devices, as expectations increase in line with spending power and - combined with rising market saturation - this is resulting in a major shift to devices that provide better user experience," she said.

But the price war is kicking off. Last month, online video company LeTV Holdings Co Ltd said its first-generation handsets, with a screen size similar to Apple Inc's iPhone 6 Plus, will "crush" Apple and Xiaomi because of low price and high performance.

The device is equipped with Qualcomm Inc's fastest mobile chip and is selling at 2,499 yuan, which is a fraction of the cost for the iPhone 6 series. LeTV said it received more than 2.6 million orders for its device less than two days after the online pre-sale started.

gaoyuan@chinadaily.com.cn

|

Zhou Hongyi, founder and CEO of Qihoo 360 Technology Co Ltd, unveils the smartphone brandQiku in Beijing on Wednesday. Qihoo is teaming up with Coolpad Group Ltd to supply Qiku handsets. Provided To China Daily |