ICBC moves to capture massive opportunities abroad

Industrial and Commercial Bank of China — the world's biggest bank by assets — is gearing up to provide a full range of financial services for projects under the Belt and Road Initiative, a senior executive said in an interview.

The bank is hoping to capture "huge" opportunities that have presented themselves because of the opening up of an infrastructure financing gap in the countries and regions related to the program, said Zhang Hongli, vice-president of ICBC.

The bank has extended loans worth about $70 billion for more than 200 projects under the initiative, and financing for projects worth up to $400 billion is in the pipeline, he said.

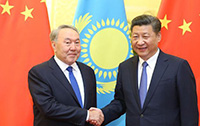

The initiative, proposed by President Xi Jinping in 2013, will accelerate the expansion of the bank's global footprint and its transition into becoming a truly global financial services provider, Zhang said.

"It represents huge opportunities for big commercial banks like us," Zhang told China Daily.

"There is a huge call for us to go international with our clients, who are making strategic investments in overseas markets," Zhang said.

In addition to providing loans, ICBC has also engaged in providing services such as financial advice, transaction settlements and foreign exchange trading, Zhang said.

Given the size of ICBC, Zhang said that the bank would focus on large and long-term strategic infrastructure projects, stressing that commercial returns were one of the bank's priorities when it selected projects.

Meanwhile, the bank is closely working with other commercial lenders, policy banks and multilateral development agencies to co-finance projects under the Belt and Road Initiative.

The latest example is an infrastructure project in Mozambique, where ICBC has partnered with financial institutions from South Korea, Italy and France to provide funding, Zhang said.

"We rely on local knowledge and work with lawyers and environmental specialists to ensure the projects are both financially and ecologically sustainable," he added.

Zhang acknowledged the potential risks in projects under the Belt and Road Initiative given the different social, economic and legal conditions in countries and regions participating in the initiative.

He said the bank had developed a solid risk evaluation and monitoring system to minimize risks.

"Every project will cost capital, and there are risks, such as foreign exchange and liquidity risks. What we do is to ensure the efficient use of our capital, which has been factored into the calculation of our strategy," Zhang said.

The banker also viewed the Belt and Road Initiative as an opportunity to lift the global profile of the Chinese currency.

"Given the size of China and its economy, there is a strong call for China to take greater responsibility on the global scene and the internationalization of the renminbi is part of that responsibility," Zhang said.

Contact the writer at lixiang@chinadaily.com.cn