Foreign CEOs believe good times can last

Updated: 2011-12-09 08:10

By Yang Ning and Gao Yuan (China Daily)

|

|||||||||||

|

A shot of the Shanghai Disney construction site last year. Walt Disney Co and Shanghai Shendi Group Co are building the resort, the US entertainment company's second theme park in China after Hong Kong. Niu Yixin / For China Daily |

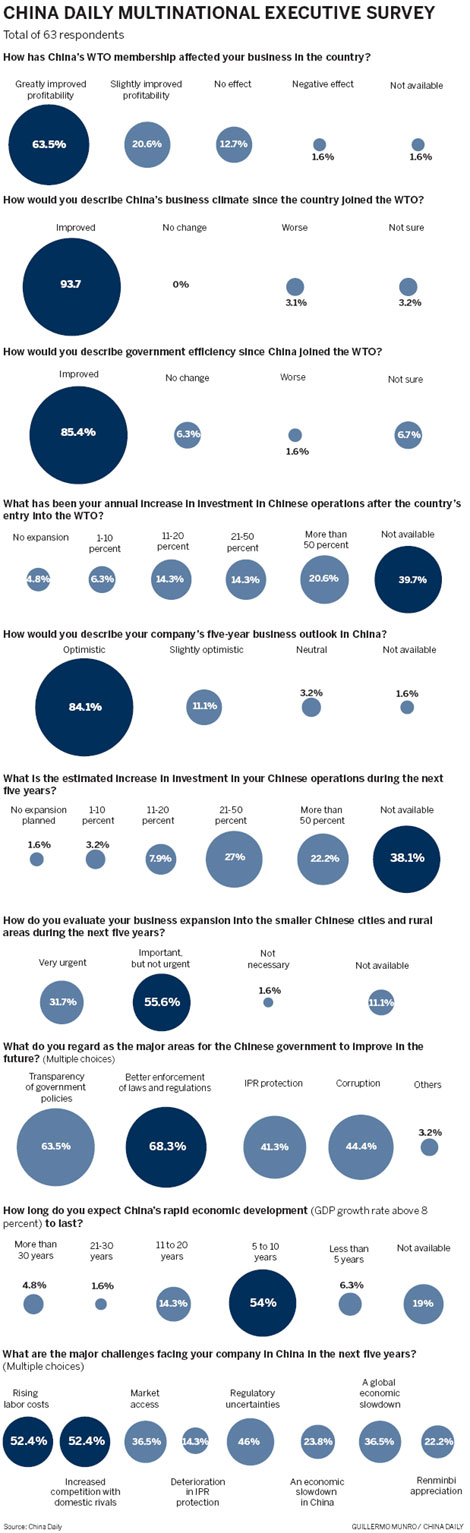

A China Daily survey of multinational business leaders in China found that most think the country is well placed to build on the growth of the past decade, as Yang Ning and Gao Yuan report.

It is a good sign that the large billboards advertising Standard Chartered Bank (China) Ltd's housing loan service are still hanging at the busiest financial street in downtown Beijing.

As the lending quota for Chinese banks will run out by the end of the year, Standard Chartered still offers 5-percent-off preferences on personal housing loan interest rates - almost the best deal the banks could offer across the city.

As a foreign bank which has operated in China over the past 150 years, Standard Chartered's strategy of focusing on emerging markets like China has enabled it to offset the negative effects of the global economic setback and boost earnings.

The London-based lender had only 11 outlets in China in 2001, when China entered the World Trade Organization (WTO), recalled Lim Cheng Teck, chief executive officer and executive vice-chairman of Standard Chartered China. Now, it has 70 branches in 18 Chinese cities, and the bank's first-half profit in China this year totaled $404 million, up 16 percent year-on-year.

"China's entry into the WTO helped us scale up our operation. When you have scale you can introduce more products and services," Lim said, adding that the progressive liberalization of the country's financial market will boost Standard Chartered's Chinese business.

Lim's opinion was echoed by 63 multinational executives in a survey conducted in October.

The China Daily Multinational Executive Survey was designed to seek the views of leading international companies on how China's WTO membership has affected their business operations in the country. The 63 participants were from a wide range of industries, from financial services and technology to automobiles and retail.

About 93.7 percent of those executives said China's business climate had improved since the country joined the WTO. Nearly 90 percent said the Chinese government's efficiency had improved during the decade. More than 84 percent of respondents said their businesses in China had enjoyed greater profitability because of China's WTO membership.

"I am glad to see that our growth in China has been on the fast track during the 10 years of China's WTO membership," said Erik Nelander, who participated in the survey. Nelander is president of the China arm of SKF Group, the world's top ball bearing manufacturer by revenue based in Sweden.

"Our business has undoubtedly enjoyed the improving investment and trade environment in China. It is with anticipation that I am looking forward to China's next fabulous 10 years."

Kelvin Leung, chief executive officer for the North Asia-Pacific region of DHL Global Forwarding, the freight unit of Deutsche Post AG, said China developed from a fragmented market into a broadly internationalized market over the past 10 years.

"We have experienced a true opening-up of the market, especially in the logistics industry," said Leung.

"It is one of the most entirely opened industries. We hardly experience any trade barriers whatsoever."

China's accession to the WTO has had a "huge and far-reaching effect" on the nation as the trade body gave the country's economy a great boost and improved its overall competitiveness, Premier Wen Jiabao said at the 110th Canton Fair in Guangzhou in October.

During the decade, China jumped from sixth to second place in the world in terms of trade volume, with its exports ranking first.

The nation's foreign trade was valued at $509.8 billion in 2001, and the figure has jumped nearly fivefold to about $3 trillion in 2010. The world's overall trade value was $30.39 trillion in 2010, up more than 140 percent on 2001's figure of $12.65 trillion.

The total value of foreign direct investment (FDI) in China amounted to $759.5 billion over the past 10 years, the highest among developing countries, according to figures released by the Ministry of Commerce.

In the first three quarters of this year, the country's FDI reached $86.68 billion, an increase of 16.6 percent year-on-year, according to the ministry.

In the China Daily survey, more than half of the multinational executives questioned said their companies' annual investment in Chinese operations had increased, while one-fifth of them said the investment had jumped by more than 50 percent.

During the past 10 years, China also imported an average of $750 billion worth of goods a year and created more than 14 million employment opportunities for its trading partners, according to Premier Wen.

Chinese companies, which looked beyond their borders to run businesses, employed about 800,000 people in overseas markets and paid some $10 billion in taxes annually, Wen said.

WTO Director-General Pascal Lamy said in October that China had delivered an "A-plus performance" since it joined the organization 10 years ago.

"The country's entry into the WTO has benefited not only China, but also the entire world," said Lamy.

The first decade of change resulting from China's WTO entry is just the beginning. China has achieved much in a short period, but it will need to make more adjustments to integrate fully into the world economy, said John Frisbie, president of the US-China Business Council, during the Boao Forum for Asia this year.

The first 10 years of China's WTO membership coincided with one of the country's fastest and best growth periods.

China was able to keep its decade-long average GDP growth rate above 10 percent, data from the National Bureau of Statistics showed. The country's GDP in 2001 was 10.97 trillion yuan ($1.73 trillion), and 39.8 trillion yuan last year.

Looking ahead, the Chinese government has set the annual GDP growth target at 7 percent over the next five years, according to the nation's 12th Five-Year Plan (2011-2015).

Most of the multinational executives were more bullish on the nation's future. In the China Daily survey, 54 percent of respondents said the Chinese economy could grow at an annual rate of more than 8 percent for the next five to 10 years, while 20.7 percent said the momentum could last at least two decades.

More than 90 percent said they were optimistic about their companies' five-year business outlook in China, and about 60 percent plan to increase their investment in China in the next five years, the survey found.

In April, US conglomerate Walt Disney Co said it and Shanghai Shendi Group Co will spend about $4.4 billion building a theme park in Shanghai.

Meanwhile, the European aircraft maker Airbus SAS received a $2.5-billion order from China Eastern Airlines in mid-October. Airbus will build 15 A330 aircraft for the nation's second- largest carrier by aircraft numbers from 2013 to 2015.

"Obviously, China's entry into the WTO has promoted economic and trade relations between China and the rest of the world, and the development of China's aviation industry is a good example. Airbus is proud to be part of it," said Lindsey Mi, vice-president of Airbus China.

Briand Greer, president of Honeywell Aerospace's Asia-Pacific region, said China has seen faster development since its accession to the WTO.

"The airport and aviation authorities in China are expanding the infrastructure very efficiently. These all point to huge growth opportunities and Honeywell is very fortunate and proud to be an integral part of this," he said.

In spite of their optimism, most executives surveyed said rising labor costs, increasing competition with domestic rivals and regulatory uncertainties are the major challenges facing their companies in China.

About 54 percent considered Chinese companies - both State-owned and private - as their major competitors in the Chinese market.

The Chinese market has become more mature and competitive, and only the best performers can be winners, regardless of their origin, said Jason Ding, senior partner and vice-president of Roland Berger Strategy Consultants.

Related Stories

IT makes all the difference 2011-12-09 10:58

Foreign investors target China's domestic market 2011-12-09 08:38

Drawing a new road map for financial prosperity 2011-12-09 08:09

Reform of and improvements to China's foreign trade system 2011-12-08 11:07

- Chinese shares close lower after data release

- Passengers prepare for annual peak

- Home appliance sales in rural China up 66% in Nov

- Collective wage talks promoted

- Good things in store for Chinese life insurers

- Dotcom could fall into disuse

- Global supermarkets conquer China

- China's Nov CPI up 4.2%, PPI up 2.7%