Chalco leads rivals for Australia project

By Wang Ying

Updated: 2006-04-19 09:11

Aluminium Corp of China Limited, the world's second-biggest alumina producer,

looks set to beat out rivals in the running for a US$2.2 billion mining project

in Australia.

The Chinese State-owned company, also know as

Chalco, has been selected from among other bidders to build a bauxite mine and

refinery based in Queensland, a senior company official in charge of Chalco's

overseas projects yesterday told China Daily.

"We are waiting for the

final approval from the (Queensland) state government," said the official,

declining to be identified.

The company will begin a detailed feasibility

study on the project after finalizing the deal this year. The study will take a

couple of years before the start-up construction of the project, the official

said.

Overseas-listed Chalco was one of 10 companies on a list to build

the mine drawn up by the Queensland government last year. BHP Billiton,

Mitsubishi Corp and Hindalco Industries Ltd were among the others that expressed

interest.

China's fast-growing economy has fuelled strong demand for

alumina, a white powder used to make aluminium. Bauxite is used to refine

alumina.

The price of alumina has seen a 53 per cent increase over the

past 12 months, as global demand soars.

Chinese aluminium companies had

paid an additional 15 billion yuan (US$1.8 billion) last year to cover the

higher costs, Xiao Yaqing, Chalco president, said in a press briefing

yesterday.

Australia has 22 per cent of the world's proven reserves of

bauxite, while China has 2 per cent. By building the new bauxite project in

Australia, Chalco will gain an addition deposit of 650 million tons, doubling

the Beijing-based company's current reserves.

Lu Youqing, vice-president

of Chinalco, parent of Chalco, yesterday said the company might add an aluminium

smelter to the bauxite and refinery project if cheaper electricity is available.

Power accounts for between 30 per cent and 40 per cent of an aluminium smelter's

costs.

|

|

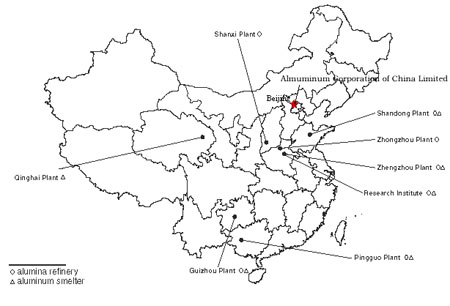

Chalcom's plants and research

institute in China |

Lu said Chinalco aims to make 80 billion yuan (US$9.9 billion) in

revenue this year, an increase of 23 per cent from the previous year. Before-tax

profit is expected to grow 19 per cent to 25 billion yuan (US$3.1 billion), he

added.

Another unnamed Chalco manager said the company was poised to take

a controlling stake in an alumina plant in Viet Nam that would cost more than

US$1 billion. The remaining shares will be held by a Vietnamese company for coal

and mineral resource development.

"We are still in talks for the project

(in Viet Nam), and construction would not start until at least two years later,"

the manger said.

In addition, the company is also talking with

counterparts in Brazil, Guinea and Mongolia to build similar mining

projects.

The official in charge of Chalco's overseas investments

yesterday disclosed that the company was conducting an investigation over a

resource-rich area in Guinea after the local government gave them approval last

November.

They are also in negotiations with neighbouring Mongolia to

participate in a copper mine with investments totalling about US$10

billion.

The Chalco senior official said Chalco's 50-50 joint-venture

alumina plant in northern Brazil with Vale do Rio Doce, the world's top iron ore

producer, would not be started until the second half of this year, due to

certain unstable factors that he refused to elaborate on.

The Brazilian

project, which will cost US$1 billion, was originally supposed to begin its

construction by June.

"We are in constant contact with the Brazilian

company for the project, and hope to begin building the project within this

year," the official said.

Beijing-based Chinalco yesterday donated a

total of 2 million yuan (US$246,609) to the All China Women's Federation and the

rural residents.

It also published

its first social responsibility report detailing its efforts to improve working

safety and increase social investments.

(For more biz stories, please visit Industry Updates) |