Top Biz News

Realty lures foreign funds

By Liu Jie (China Daily)

Updated: 2007-03-02 10:00

|

Large Medium Small |

China's real estate sector continued to attract an increasing level of foreign investment in 2006, particularly cities in the Pearl River Delta.

China's real estate sector continued to attract an increasing level of foreign investment in 2006, particularly cities in the Pearl River Delta.

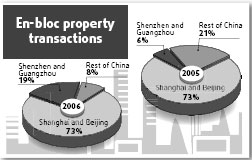

According to the Asia-Pacific Property Market Overview released by international property adviser Debenham Tie Leung (DTZ), the total number of building transactions involving foreign investment jumped 38 percent from 2005, while the total consideration surged 67 percent from 17.7 billion yuan to 29.5 billion yuan.

"In 2006, there were 322 nationwide real estate investments with a unit value of $10 million or more, with a total sum of 157.747 billion yuan. These figures were up by 22 percent and 33 percent compared to 2005," said Alva To, director of Consulting and Research.

Of the 322 investment transactions, 273 or 85 percent were land purchases for real estate development, while the remaining 49 or 15 percent involved theacquisitionof buildings.

Compared with 2005, the number of land transactions increased by 19 percent, while that of buildings witnessed a more remarkable growth of 44 percent, a sign that the latter is getting a larger share of the investment pie.

"The source of funds for these two types of real estate investment also differs substantially. While domestic funds are major land buyers, accounting for 80 percent of site transactions, foreign funds took the stage in building transactions by executing 82 percent of the deals," said To.

| 分享按钮 |