India's Iron ore duties worry importers

By Jiang Wei (China Daily)Updated: 2007-03-07 08:28

India's imposition of export duties on iron ore from this

month will hurt Chinese importers, industry insiders said yesterday.

India's imposition of export duties on iron ore from this

month will hurt Chinese importers, industry insiders said yesterday.

India's Finance Minister announced at the end of February a plan which took effect on March 1 to levy an export duty of Rs 300 ($6.78) per ton of iron ore.

| |||

The Chamber of Commerce held a conference yesterday in Beijing of iron ore importers to discuss its response to India's duties, but officials declined to detail the conference's outcomes.

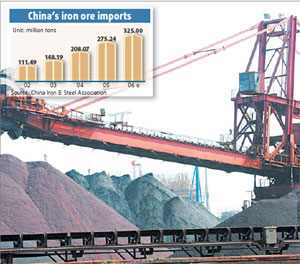

India is now the third-largest exporter of Chinese iron ore after Australia and Brazil, accounting for 23 percent of total imports.

Indian iron ore exports will decrease significantly, and there will be a hike in domestic iron ore prices, forecasted Zhang Dongliang, an analyst with the steel consultancy Shanghai Mysteel.

The announcement of the new Indian policy has come as a shock for Chinese importers.

A trader surnamed Ding with Hong Kong Pioneer Metals Co Ltd, one of mainland's largest iron ore traders, was quoted by Interfax as saying that Indian iron ore will lose its price advantage over Brazilian and Australian ores.

Ding said his company has been forced to temporarily halt all iron ore sales, because domestic steel mills will not accept such a sudden price hike.

The company also halted iron ore imports from Australia and Brazil because of a dramatic surge in orders from domestic steel mills for Australian and Brazilian iron ore.

It is estimated that pig iron production costs would increase by at least 80 yuan per ton if steel mills use Indian iron ore.

But Pioneer Metals' Ding predicted that trade with India will resume soon.

He added that they will talk with suppliers about the free-on-board price to offset the recent price increase.

After Australian and Brazilian miners increased their iron ore price by 71.5 percent, 19 percent and 9.5 percent during the past three years, a number of Chinese mills and importers turned to India to cash in on the competitive prices.

(China Daily 03/07/2007 page13)

(For more biz stories, please visit Industry Updates)