Time to turn focus on private fund sector

By Jin Jing (China Daily)Updated: 2007-04-11 09:03

Chinese regulators are beginning to turn their attention to

the 600-700 billion yuan private fund market, which is expanding at a brisk

speed, driven by the stock market boom.

Chinese regulators are beginning to turn their attention to

the 600-700 billion yuan private fund market, which is expanding at a brisk

speed, driven by the stock market boom.

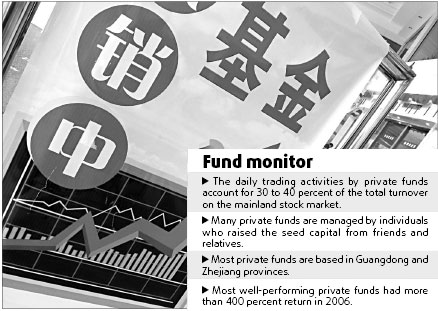

The daily trading activities by these private funds account for 30 to 40 percent of the total turnover on the mainland stock market, according to a recent report from the Beijing-based Central University of Finance and Economics.

"The existence of these private funds need to be recognized and they must be brought into the regulatory framework," Ba Shusong, deputy director of the financial research institute of the Development Research Center of State Council, was quoted as saying by the official China Securities Journal.

Many private funds are managed by individuals who raised the seed capital from friends and relatives. There are also funds raised by trusts or securities companies but managed by other private fund companies.

Most private funds are based in Guangdong and Zhejiang provinces. There are also some in big cities, such as Beijing and Shanghai.

"Private funds are more flexible in operation, compared with mutual funds, because they are not subject to any regulations," said a fund manager surnamed Zhang from a small-scale fund with 100 million yuan in assets in Shanghai.

| |||

In comparison, the average return of equity mutual funds was 143 percent in 2006, according to Lipper, a fund information provider.

"We can invest all the money we raise in one stock, or invest no money in the stock market at all," said Zhang.

Chinese fund regulations stipulate that mutual funds can invest no more than 10 percent of their total net asset value in one stock. Besides, all mutual funds have set investment portfolios before they are issued.

Gu Baojun, also a private fund manager, said private funds can set a longer closing period, usually one year, before which investors cannot retrieve their money without paying a penalty. In contrast, mutual fund investors are free to opt out at any time.

"We are more flexible in operation so we can pursue a higher profit, but with higher risks," said Zhang.

Although private funds are usually raised from friends and acquaintances, some managers have begun marketing their funds on the Internet by websites or blogs.

CZZX Asset Management Company, a Shenzhen-based private fund established in 2003, posted its returns every year on the main page of its website to attract clients. A private fund manager set up a blog on eastmoney.com with the name of "Jia Yu Cun Yan" to offer his opinion on the current stock market, and also as a way of attracting investors.

Chinese regulators have finished drafting a private funds policy, the China Securities Journal has reported. According to the proposed policy, private funds have to submit detailed prospectus, including total asset, company background and investment strategy, in order to be legally recognized.

Some analysts said the government should not impose too much supervision on the private funds, some of which will probably disappear anyway when the stock market plummets.

"Besides, it is difficult for the government to supervise individually raised small-scale private funds," said Zhou Liang, a fund research manager from Lipper. "We can now use corporate law and trust law to regulate some private funds."

A recent report from Shenzhen Stock Exchange suggested that the government should give private funds the legal identity to optimize the investor structure in China's financial market, but needs to separate the supervision framework between private funds and mutual funds.

(China Daily 04/11/2007 page15)

(For more biz stories, please visit Industry Updates)