Shanghai REIT faces hurdles

By Jin Jing (China Daily)Updated: 2007-05-11 08:35

REITs (real estate investment trusts), fast gaining popularity in international markets, are making their way to Shanghai.

"The Shanghai Stock Exchange has already put in place a REIT trading system, and will actively promote the products to be listed on the bourse," Chen Zhizuo, SSE's supervisor for product development, has said.

Trading will likely begin once draft regulations on REITs are ratified by the government, said Charles Zhang, associate director of Research and Consultancy at Colliers International Shanghai, a real estate service provider.

REITs provide investors a way of buying shares in a real estate portfolio from the stock exchange. They also offer real estate developers and property holding companies a way of raising capital directly from the market without having to go through the costly IPO process.

But there are several hurdles to overcome before a healthy REIT market can be established in Shanghai, property agents and investment analysts have said.

"The current Chinese investment market is not mature enough to introduce REITs, which require specific laws and regulations to ensure proper and healthy operation," said Zhang.

"No existing investment laws are applicable to REITs, and this is the major obstacle China must face before launching REITs," Zhang added.

Ren Zhuang, a real estate analyst from Industrial Securities, warned that the pricing structure of China's commercial real estate market is not mature enough for proper evaluation. This means potential risks for investors.

Despite potential problems, analysts agree REITs will boost China's financial derivatives market in the future.

"Investors will be attracted to REITs, and many mutual fund companies will probably add REITs to their investment portfolio," said Zhang.

"Given China's large real estate market, there is a great need for developers to raise capital and also for investors to choose attractive yields products," he added.

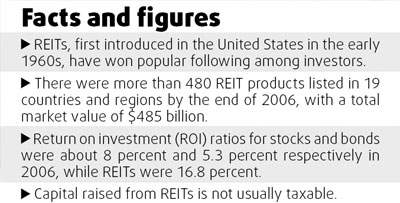

REITs, first introduced in the United States in the early 1960s, have won popular following among investors.

"The average return from a REIT investment is between bond and equity

investments," Zhang said. "Investors can get a stable income because 90 percent

of the income from the underlying properties in a typical REIT must be

distributed to investors."

According to global statistics from Harvest Fund, return on investment (ROI) ratios for stocks and bonds were about 8 percent and 5.3 percent respectively in 2006, while REITs were 16.8 percent. Capital raised from REITs is not usually taxable.

According to Harvest, there were more than 480 REIT products listed in 19 countries and regions by the end of 2006, with a total market value of $485 billion.

Ren at Industrial Securities said REITs are an easier way for companies to raise capital than an IPO (initial public offering), which aren't always available to bottom- or mid-tier real estate companies, or a bank loan, which can be difficult to secure.

Zhang agreed, adding that REITs need a long-term capital investment from investors in order to improve the real estate management.

According to the SSE's Chen, the exchange is developing a worldwide leading Next Generation System (NGTS) that can provide three different trading platforms for the product, including a cross-matching system, a bulking trading transfer platform and a bilateral quoting platform for fixed-income products with completed market marker system.

Chen said the exchange is also considering taking measures to increase market liquidity, including the expanding mortgage loans and introducing related REIT index products.

"Compared with the inter-bank market and the property rights exchange, the stock exchange has an advantage of wide investors base, timely information disclosure and effective supervision," said Chen, quoted in China Business News.

(China Daily 05/11/2007 page15)

(For more biz stories, please visit Industry Updates)