Center

Opinions mixed on measures to cool down share market

By Liu Jie (China Daily)

Updated: 2007-06-01 09:40

|

Large Medium Small |

Chinese people have mixed feelings about the central bank's efforts to cool down the sizzling stock market, but the majority believe it is necessary for the government to act now.

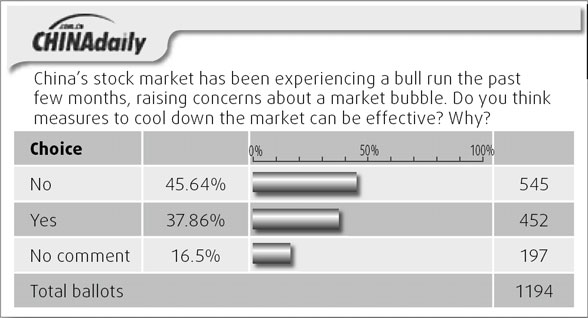

In a poll conducted on China Daily's website, www.chinadaily.com.cn, 452 of 1,194 respondents, or 37.86 percent, said the curbing measures will effectively cool the market. But 545 respondents, or 45.64 percent, disagreed, while 197 or 16.5 percent declined to comment.

China's stock market has experienced a bull run in recent months, raising concerns about a market bubble.

The People'sBank of China, China's central bank, announced a string of monetary and exchange rate policies on May 18 amid worries that mainland stocks are surging to dangerous new highs.

|

The central bank raised banks' reserve ratio by 0.5 percentage point to 11.5 percent, which will take effect on June 5.

It also raised one-year deposit rates by 27 basis points and lending rates by 18 basis points from May 19.

The daily interbank trading band of therenminbiexchange rate against the US dollar was widened from 0.3 percent to 0.5 percent from May 21.

The stamp tax on securities trading has been raised from 0.1 percent to 0.3 percent from Wednesday.

All of these measures were aimed at curbing inflow into the mainland's bourses and short-term speculation in the market.

|

|||

"I think the Chinese government can keep down everything when it needs to protect the majority," said a respondent, believing that the hikes are the right and wise move so far.

Other respondents said the measures were too mild to hold down the market, which remains flush with liquidity.

"Although the central bank has raised deposit rates several times, the one-year benchmark deposit rate is still virtually negative when interest tax is deducted," a respondent said, adding that a slight interest rate hike is of little concern to investors, who want to make "big, quick bucks" in a short time.

Apart from the above opinions, other survey participants maintained a wait-and-see attitude.

"Could these policies mean cold water over the red-hot stock market? It's still hard to tell," one said.

"As the market has climbed to such a high record, some individual investors, especially those with poor knowledge of the stock market and its risks, are crazy to get money and reluctant to draw back."

No matter whether the curbing measures can be effective or not, the majority of those questioned said the government is right to act right now in order to avoid a disastrous bubble burst.

"I support the authority to regulate the overheating stock market," one respondent said, explaining that the majority of people participating in the market are irrational and tempted by profit.

| 分享按钮 |