Gas import ruling not related to global trends

By Wang Yu (China Daily)Updated: 2007-06-15 10:19

China's decision not to impose any restrictions on natural gas and LNG imports is supposed to secure diversified gas imports and better meet local demand.

The move will not necessarily lead to an import surge in the short term and it has nothing to do with the global price hike, according to China's commerce watchdog and industry sources.

"At present, China has only set up one liquefied natural gas (LNG) receiving terminal for long-term import contract. We have only one LNG supplier (Australia) and only one importer. To make gas importing easier, we decided to eliminate 'automatic import approval' for natural gas from June 10 on. This has nothing to do with the international market," China's Ministry of Commerce (MOFCOM) revealed exclusively to China Daily yesterday.

The elimination of the "automatic import approval" will not lead to the

adoption of an import permission or quota system to govern the trading of gas

and LNG, and some Chinese media simply misunderstood MOFCOM's statement late

last month, the commerce watchdog said.

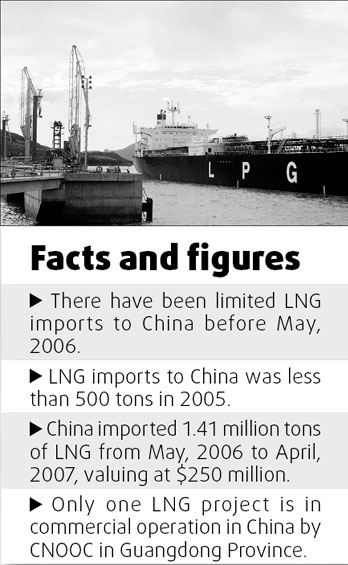

China's natural gas and LNG imports are small in terms of volume, especially compared to developed countries such as Japan and South Korea. The commodities deserve priority position for further development and application in China. Therefore, gas and LNG imports should be given the green light, sources from China National Offshore Oil Corporation (CNOOC), a major gas producer and importer, told China Daily yesterday.

"The national policy of supporting natural gas consumption and production is consistent, because of concerns for environment protection and stable energy supply," an expert with CNOOC said.

China's leading oil producers, including PetroChina and CNOOC, are boosting gas output and imports to meet demands. The National Development and Reform Commission, the country's top economic planner, wants natural gas to account for 5.3 percent of the energy consumption structure by 2010, up from 3 percent now.

Because of soaring global oil prices and environmental concerns, more Chinese local buyers are looking for overseas natural gas supplies. This means major Chinese gas importers, such as CNOOC, often have to pay higher prices for overseas natural gas and LNG, said Han Xiaoping, executive vice-president of Beijing Falcon Pioneer Technology Co Ltd.

Facing the potential competition from within China, CNOOC maintains its composure.

"Gas and LNG importing is capital intensive and has to depend on a long industrial chain for profit. Therefore, small companies cannot afford tapping the segment in the short term, despite of the open market environment," said Liu Junshan, a senior press officer with CNOOC.

CNOOC argued that China's impact on global natural gas prices is limited.

"The price hike of natural gas in the international market was mainly triggered by the global oil price surge. It's a complicated issue that involves many factors. A single company or country's behavior is not strong enough to stir up the whole global market," another source from CNOOC told China Daily.

China is presently a minor gas importer compared to developed industrial

countries, Liu added.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)