Index falls 4.03% as panic grows among investors

By Li Zengxin (chinadaily.com.cn)Updated: 2007-06-28 15:49

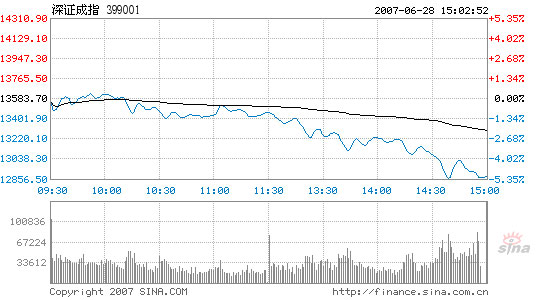

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, opened lower from 13,544.06 and closed at 12,882.18, down 701.53 points or 5.16 percent. It went through the day within a range from 12,856.26 to 13,629.45.

Shenzhen Component

Index

Source: www.sina.com.cn

Of its a shares, 500 fell, 79 ended flat and only 34 went up today. Beijing Centergate Technology Holdings rose over 10 percent to rank on top of the list for the second day while Jianmen Sugarcane Chemical Factory Group dropped more than 10 percent on the bottom. Sinopec Wuhan Phoenix, with the largest trading volume in Shenzhen, grew 1.68 percent while Shenzhen Development Bank, with the largest transaction value, slid as much as 6.64 percent, pressing the index down.

Stocks in the mining, paper production and food industries performed relatively better. Shanxi Xishan Coal and Electricity Power pioneered the mining sector in with a 0.92 percent surge.

B shares finished down. Of the 109 listed B shares, 91 went down and 10 ended flat. Anhui Gujing Distillery was again the biggest gainer. Closed-end mutual funds mostly fell in the plunging waves.

New moves were made on the long-awaited financial futures. The China Financial Futures Exchange (CFFEX) yesterday said the China Securities Regulatory Commission has approved the trading rules, a crucial step toward the launch of the mainland's first index futures market.

CFFEX has said there is no specific target date for the launch, but industry insiders have predicted it will be sometime this year.

The approved trading rules cover trading practices, clearing procedures, members' rights and obligations, risk control, information management, hedging operations and the investigation of and penalties for irregular trading.

It is widely believed that the approval of the trading rules has cleared one of the final hurdles in the long preparation process that has tested the patience of many prospective participants, particularly institutional investors who would welcome an effective hedging instrument to minimize risks in an increasingly volatile stock market.

The central bank, on the other side, is concerned about inflationary pressure and is ready to make use of a range of monetary policy tools to curb prices rises, a senior official said yesterday. "The central bank is firm on keeping inflation under control," Yi Gang, assistant governor of the People's Bank of China, told reporters at a fiscal forum in Beijing. "We have many tools at hand," Yi added.

People have been expecting the central bank to raise interest rates or take other tightening measures to rein in rising prices. The central bank will make proper use of the tools to control inflation and keep price levels and economic growth stable, Yi said.

He added that increased asset prices would not be a factor in taking tightening measures. "We are mainly concerned with inflation, especially the consumer price index in China," he said. In the long run, the central bank aims to keep real interest rates positive, Yi said.

| 1 | 2 |

(For more biz stories, please visit Industry Updates)