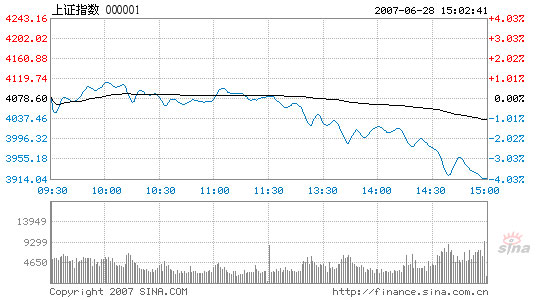

Index falls 4.03% amid expectation of interest tax slash, 06/28

By Li Zengxin (chinadaily.com.cn)Updated: 2007-06-28 15:49 Chinese stocks plunged 4.03 percent amid expectation of cut or suspension of the tax on interest income today. The Shanghai Composite Index closed at 3,914.20, down 164.39 points, the largest single-day slump since June 4.

Lawmakers yesterday debated a bill authorizing the State Council to cut or suspend tax on interest accrued from bank deposits - a move seen as helping rein in excessive liquidity and expected to be passed on tomorrow's voting by the National People's Congress.

Total turnover of the stocks enclosed by the two major indices was 191.9 billion yuan, the second-smallest since May 29, after June 14 with a 185.4 billion yuan turnover.

Like most of the recent volatile trading days, the benchmark Shanghai Composite Index ran through the morning session in short-tailed fluctuations without a clear trend. After a higher opening from 4,080.19, the index hit the highest 4113.28, but failed to stay. In the afternoon, however, it met little resistance on a way of descending. Finally, it closed a little higher than today's lowest point of 3,912.81, again losing the 4,000-point mark regained just yesterday.

Shanghai Composite

Index

Source: www.sina.com.cn

Of the A shares listed in Shanghai, merely 67 went up, 704 dropped and 68 finished unchanged. Shanghai Broadband Technology was up 29.15 percent on top of the gainer's list. Beijing Tianhong Baoye Real Estate and Jiangxi Hongdu Aviation Industry also grew nearly 10 percent as the biggest gainers. Zhejiang Furun, on the other hand, dropped 10.06 percent to lead the fall by the large number of losers today.

Inner Mongolian Baotou Steel Union became the largest trader in terms of trading volume, and rose 7.37 percent to 6.99 yuan. China Yangtze Power, with the largest transaction value, was up 6.03 percent. But the dual couldn't lift the whole index as other large traders were mostly dragging it down.

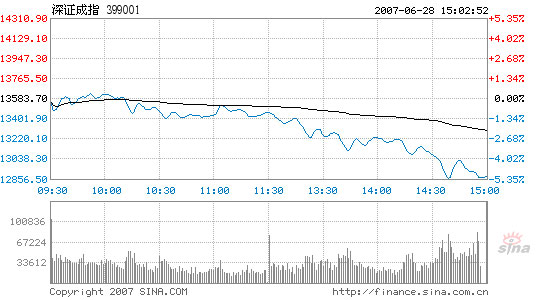

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, opened lower from 13,544.06 and closed at 12,882.18, down 701.53 points or 5.16 percent. It went through the day within a range from 12,856.26 to 13,629.45.

Shenzhen Component

Index

Source: www.sina.com.cn

Of it's a shares, 500 fell, 79 ended flat and only 34 went up today. Beijing

Centergate Technology Holdings rose over 10 percent to rank on top of the list

for the second day while Jianmen Sugarcane Chemical Factory Group dropped more

than 10 percent on the bottom. Sinopec Wuhan Phoenix, with the largest trading

volume in Shenzhen, grew 1.68 percent while Shenzhen Development Bank, with the

largest transaction value, slid as much as 6.64 percent, pressing the index

down.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)