Property price rises spread to lower tiers

By Hu Yuanyuan (China Daily)Updated: 2007-07-11 09:06

Beihai, a small city at the southern end of South China's

Guangxi Zhuang Autonomous Region, has been on the top of a list by the National

Development and Reform Commission (NDRC) for three months in a row due to its

skyrocketing property prices.

Beihai, a small city at the southern end of South China's

Guangxi Zhuang Autonomous Region, has been on the top of a list by the National

Development and Reform Commission (NDRC) for three months in a row due to its

skyrocketing property prices.

Prices in April alone rose 23.6 percent year-on-year, far exceeding the 11.3 percent jump of Shenzhen and 10.7 percent rise in Beijing during the same period.

Bengbu, a city in East China's Anhui Province, also found itself on the list. The city, ranked 182nd in overall economic strength in the country last year, appears as No 5 on the chart with a May growth rate of 10.2 percent.

Soaring prices are partly due to increasing movements by property developers into second-tier cities, said an industry analyst who declined to be named.

Due to comparatively low land prices and little competition, Chinese real estate firms, as well as foreign investors, all quickened their expansion into secondary cities beginning last year.

Yet according to Pan Shiyi, chairman of SOHO China, surging property prices in second-tier cities have been mainly driven by rising local economies and demand.

"Property developers' expansion, in fact, increased the supply on the local market, which should be good news for the balance between supply and demand," Pan told China Daily.

Robert Lie, CEO of ING Real Estate Investment Management Asia, said his company is optimistic about economic prospects in those locales, with second-tier cities part of their strategic focus this year due to a demand he says will grow at an average of five million apartments each year by 2015.

Lian Younong, mayor of Beihai, said on June 27 that soaring property prices in the city were due to a strong economy rather than a growing bubble in the sector. Beihai's property prices, he said, will continue to rise in the future.

Along with second-tier cities, the municipalities of Beijing, Shanghai, Shenzhen and Guangzhou also saw a sizzling property market despite government efforts to restrain prices.

Statistics from the Beijing Real Estate Transaction Management website show that the average cost for new residential buildings in the capital jumped by 20.4 percent in June compared with the previous month, hitting 10,280 yuan per square meter.

Shenzhen also experienced growth of over 30 percent over the past two months, with the average price now exceeding 20,000 yuan per square meter in the urban area of Guan'nei.

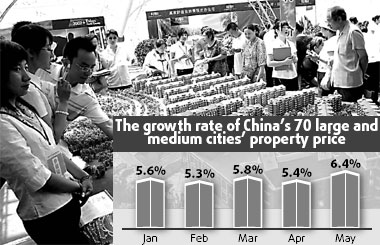

According to the NDRC, property prices among China's 70 large- and medium-sized cities jumped by 6.4 percent year-on-year in May, the highest monthly figure since 2006.

Although speculative buying and unwillingness by property developers to sell

are partly fueling rising property prices, demand still exceeds supply and

remains the major cause for continued price increases, experts say.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)

|

|