Market responds to CPI result smoothly

Updated: 2007-08-13 16:35

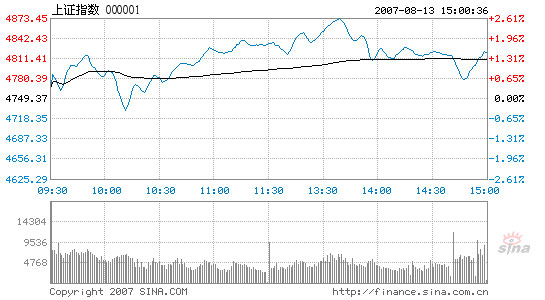

The stock market handled the release of July's consumer price index (CPI) results this morning smoothly, as the 10-year high 5.6 percent growth in CPI was apparently anticipated. With a 66-point plunge in response to the announcement, the Shanghai Composite Index soon came back to a new record-high close.

Total turnover of stocks in the major indices was 224.9 billion yuan, higher than last Friday.

Shanghai Composite Index

Source: www.sina.com.cn

The benchmark Shanghai index opened higher at 4,768.62 and started to climb after a short dive. When the National Bureau of Statistics announced the July CPI figure, it slid quickly to its lowest, 4,728.89. But there it made a turnaround. In the afternoon, the index almost broke 4,900, hitting 4,872.55, the highest of the day. With a few setbacks, it finally ended the day at 4,820.06, up 70.69 points or 1.49 percent.

Of the A shares listed in Shanghai, 338 went up today while 430 closed down and 74 finished flat. Henan Lianhua Gourmet Powder, rising 10.09 percent to 5.89 yuan, topped the gainers' list to lead another 14 stocks with 10 percent growth on the first places. Beijing Vantone Pioneer Real Estate, however, dropped another 10 percent as the biggest loser, on the second day after last Friday.

Bank of China, with the largest trading volume, was up 8.61 percent. Sinopec, with the largest transaction value, added 0.5 yuan to its share price.

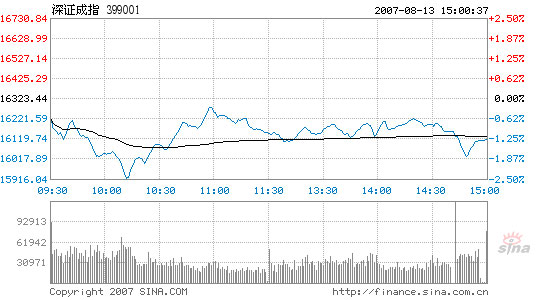

Shenzhen Component Index

Source: www.sina.com.cn

The Shenzhen Component Index, without many index-driven heavyweight stocks, performed worse than its Shanghai counterpart. Opening lower from 16,215.57, it went through the day within a range of 15,913.56 to 16,281.29, both lower than Friday's closing level. The index closed at 16,116.11, down 207.33 points or 1.27 percent.

Of the A shares, 252 went up, 299 closed down, and 77 ended unchanged. New shares Beijing Bdstart Navigation, GRG Banking Equipment, and Beijing Shiji Information Technology went up 381 percent, 364 percent, and 287 percent respectively, on top of the growth list.

TCL, with the largest trading volume, rose 4.36 percent while China Vanke, with the largest transaction value, slipped 1.87 percent.

Stocks in the timber, paper, and hydropower sectors performed better than the others. Both closed-end mutual funds and B shares were down. Of the 109 B shares, only 21 went up and 7 ended flat.

|

||

|

|