Fixed-asset investments zoom

Updated: 2007-08-17 07:14

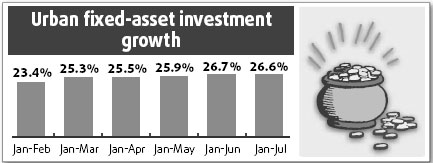

Local governments and property developers have accelerated fixed-asset investment, which grew at 26.6 percent year-on-year from January to July, according to official statistics.

The figure, up from 23.6 percent in the first quarter, shows the central government needs further tightening measures to tame the blistering economic growth.

Since 2003, when the government started taking steps to cool down the economy, mainly driven by investments, it has grown by more than 10 percent on average.

With real estate prices continuing to rise, property developers have pumped 1.21 trillion yuan (US$159.05 billion) into the economy in the first seven months, up 28.9 percent compared with the same period last year, the National Bureau of Statistics (NBS) said yesterday.

In July, the investment growth rate dipped slightly because of extreme weather conditions, especially flooding, according to an analysis by Asia Economics Research Group of Goldman Sachs. Fixed-asset investment growth grew 26.2 percent year-on-year in July, down from June's 28.5 percent.

The NBS said that during the first seven months, the fixed-asset investment in urban areas climbed to 5.67 trillion yuan. The number of new investment projects was 132,099, an increase of 17,168 from the same period last year.

The new figures come on the heels of Premier Wen Jiabao's declaration that cooling the overheating economy and checking inflation are the top priorities for the country.

Many economists want the government to use money market tools to achieve the goal. Lin Yueqin, a researcher with the Chinese Academy of Social Sciences, said: "The central bank should use the monetary tools as soon as possible."

But from a long-term perspective, Lin said, the government should update its industrial policies in accordance with its economic development goal.

Local governments are the main drivers of the investment spree. The new statistics indicate fixed-asset investment of local governments have risen 27.9 percent year-on-year while that of the central government grew 15.4 percent in the past seven months.

Lin urged the leadership to consider reforming the performance assessment system of the local governments, which currently puts more emphasis on economic achievements.

(China Daily 08/17/2007 page14)