Boom, bust in area beset by foreclosures

Updated: 2007-10-07 10:26

Out on Phoenix's suburban fringes, where cement mixers are fast colonizing what's left of the hay and cotton fields, the day is winding to a close. The home hour has arrived.

But sundown gives away a troubling secret: Behind dark windows and many unanswered doors, it's clear nobody is coming home.

|

|

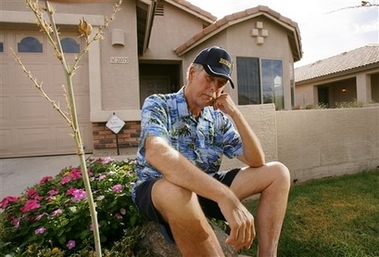

Greg Giniel sits out in front of his home which is in foreclosure in the Villages of Queen Creek housing development Thursday, September 27, 2007 in Queen Creek, Arizona. Giniel says he will try to buy his home back at the foreclosure auction in November.[Agencies] |

The ranch home on Via del Palo where the newspaper in the driveway has been sitting unclaimed since April. The house at the corner of 223rd Court with faded fliers stuck in the door. The two-story on Via del Rancho with the phone book on the step.

They're all empty, left behind by a rising tide of foreclosures.

This neighborhood has a still-unfolding story to tell, and it is not always a comfortable one to hear.

Not long ago, builders were raising home prices here thousands of dollars week after week. Families pitched tents in front of sales offices and waited for Saturday morning lotteries to win the right to buy. Buyers, including more than a few speculators, gambled with loans whose risks were obscured by euphoria.

This is the tale of how America's real estate boom came to a seemingly ordinary subdivision called the Villages at Queen Creek, where the whipsaw of easy credit has led to some extraordinary times.

They were the best of times, for a while. The empty homes, though, raise serious doubts about what comes next.

As the United States confronts skyrocketing foreclosures, and policymakers try to contain a symptomatic credit crunch, what is happening here and in scores of similar neighborhoods is worth considering.

Because while the pressures at work in Queen Creek were extreme, the choices people made, and the consequences of those decisions, are not so different from those faced by thousands of other homeowners and their neighbors.

"Honestly," says Joy Kessler, a mother of three boys standing on the doorstep of the house she and her husband are surrendering to foreclosure, "if you were in this situation, what would you do?"

|

||

|

|