Stocks robust on growing trade volume

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-12-27 17:32

Updated: 2007-12-27 17:32

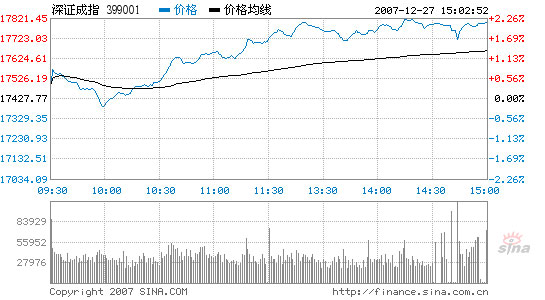

Shenzhen Component Index

Source: sina.com.cn

As the year draws to an end, investors expect the stock market to enjoy a "perfect" close after an outstanding year of non-stop development. As an apparent proof, Chinese companies raised record funds by initial public offerings (IPOs) and additional placement this year, according to a recent release.

Money collected by the Shanghai and Shenzhen stock markets hit 830.63 billion yuan as of December 21. That amount shot up nearly three-fold from last year, fuelled largely by mania for investing in IPOs. Purchases of subsequent share offerings and corporate bonds added to the total.

The funds raised over the year were estimated to exceed 841.49 billion yuan. The figure was equivalent to the total amount collected by the two bourses in the first 14 years since their late 1990 establishment.

Analysts also anticipate a strong bull run in the first quarter next year, despite the growing pressure from market scale enlargement, non-tradable share de-freezing, the launch of index futures, and a planned growth market for smaller companies.

They said the time lag for the tightening policies to take hold in the economy and the capital market will leave the first quarter mostly unaffected, and robust growth in share prices will be supported by inflation, currency appreciation, and increase in consumption.

|

|