Price stability a priority: Wen

By Wang Xu (China Daily)

Updated: 2008-03-06 09:12

Updated: 2008-03-06 09:12

Mounting inflationary pressures are the top concern, Premier Wen Jiabao said yesterday, and pledged to take effective measures to stabilize prices and prevent the economy from overheating.

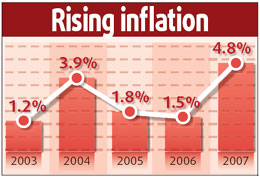

The government aims to keep the consumer price index (CPI) - a key gauge of inflation - at around 4.8 percent this year, the same level as last year, Wen said in his Government Work Report.

Meanwhile, growth in the world's fourth-largest economy is expected to slow to 8 percent, Wen told nearly 3,000 deputies at the opening session of the National People's Congress, the top legislature, at the Great Hall of the People.

"One major task in macroeconomic regulation this year is to prevent prices from rising too fast," Wen said. "We must take effective measures to increase supply while curbing excessive demand."

The CPI surged to a 13-year high in 2007, surpassing the government's goal of 3 percent set at the beginning of the year. The price hikes were driven mainly by soaring food prices; and the nation's booming economy fuelled demand for commodities and goods ranging from oil to cement.

"The targets set for this year suggest the government is fully aware of the difficulties and uncertainties the economy faces," said Zhao Xijun, a professor at Renmin University of China. "The measures put forward could prove effective in attaining the aim."

The premier said the government will boost the production of daily necessities such as grain, vegetable oil and meat to stabilize prices. It will also tightly control grain exports and industrial use of grain, and increase imports of consumer products that are in short supply.

Moreover, the government will carefully time price revisions of resource products and public services to prevent cascading price rises.

"Last year's price increases are still exerting a fairly strong influence making it difficult to bring them under control," said Wen, adding the government will follow a prudent fiscal policy and a tight monetary policy.

China shifted its monetary stance from "prudent" to "tight" last year and moved to tighten credit. Also last year, the central bank raised the interest rate six times, and the ratio of cash commercial lenders need to set aside in deposits with the central bank 10 times.

While the moves have helped rein in fixed asset investment, some analysts have suggested the government may need to loosen its austerity measures in the face of a slowing global economy.

Wen said the government is keenly aware of the uncertainties at home and abroad, such as the subprime crisis in the US, worsening trade protectionism, as well as rising grain and oil prices in the international market.

"We need to maintain an appropriate pace, focus and intensity in macroeconomic controls," Wen said.

The inflation target is achievable, provided there are no additional negative supply shocks, said Sun Mingchun, an economist with Lehman Brothers.

Sun expects the CPI to ease to 4.4 percent this year from 4.8 percent last year as food price rises ease in the second half of the year.

Most analysts agree food price hikes are likely to slow in the latter half thanks to government's favorable policies on agricultural production. However, some cautioned that the rising cost of labor, land and environment protection would add to inflation.

The real concern is whether non-food sectors take the lead to drive up inflation, said Shen Minggao, a Beijing-based economist with Citigroup, citing the recent 65-percent price hikes in iron ore.

China's Producer Price Index climbed 6.1 percent in January from a year earlier, the fastest clip in three years. The index, a leading indicator of consumer price inflation, measures the average change in the prices received by producers for their output, therefore reflecting potential inflationary trends.

|

||

|

|