|

BIZCHINA> Industries

|

|

Environment: Making money from trading emissions

By Sun Xiaohua (China Daily)

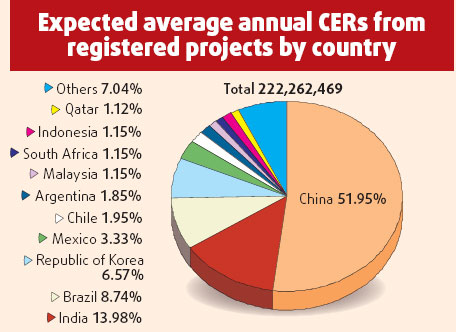

Updated: 2008-09-15 11:03 "To avoid this situation of projects being stopped halfway, CDM developers should closely follow international conferences and negotiations. CDM is new, and it's still finding its way and improving," Lu says. "Because the business largely depends on rich countries' commitment to the international convention, project developers should also keep an eye on the climate change policies of their business partners' countries." Every two months, Lu goes to Bonn, Germany, the UNFCCC secretariat location, to attend the regular meeting of the CDM executive board. New CDM issues are discussed at the meeting and CDM projects awaiting registration are reviewed. When he returns, he writes a report on the latest amendments to the CDM rules and posts it on an official website. Many developers rely on this report. "Any change will influence their (the developers') investment plans, bringing them loss or benefit," Lu says. International law is another area where more information and communication is needed. The Nanjing Tianjingwa landfill CDM project, one of the earliest carbon trading projects in China, is another gloomy tale for investors. The project's CER target was 200,000 tons of CO2s per year; however, when the project started, the CER was just 20,000 tons per year. "To avoid having to pay huge amounts of compensation for breach of contract, Chinese sellers must make it clear in the contract who will be responsible for any economic losses incurred, in the event of the CER falling below the target," Lu says. "There's a lot of misunderstanding about CDM, and especially criticism of China for selling the carbon credits at a low price - half that on the European market," Lu says. But Lu believes China's current carbon credit pricing is appropriate. In China, Lu says, carbon traders sign a futures contract, while in the European market, CER trade takes place on a spot market. The futures market is always high-risk and influenced by unexpected elements, so the price is relatively low, he says. Under the Kyoto Protocol, Eastern European nations like Russia and the Ukraine can emit at 1990 levels in the compliance period from 2008 to 2012. However, due to the collapse of their economies, emissions are currently far below the 1990 levels. Russian CO2 emissions are currently only 70 percent of 1990 emissions. That's projected to increase to between about 80 and 90 percent of 1990 levels by 2010. Under trading rules supported by most non-EU developed nations, Eastern European nations would be able to sell these surplus allowable emission rights. "As the Kyoto Protocol will expire in 2012, I suggest Chinese carbon traders go ahead and make deals, if the price is acceptable," Lu says. The National Development and Reform Commission has already ratified 1,444 CDM projects, of which only 260 have been registered with the United Nations, got CERs and benefited the sellers. Investors in the remaining 1,184 projects are anxiously awaiting UN registration - if it's not forthcoming, their early investment will be lost. "It's hard to tell whether the UN will register these projects," Lu says. But he is upbeat about the carbon trading market post-Kyoto Protocol after 2012, despite slow progress with the international negotiations. "The Kyoto Protocol is the fruit of years of effort by the international community," he says. "It will not stop overnight. And I believe it will continue. As for the CDM, the system will be improved but carbon trading will also continue." Liu Deshun, a professor at Tsinghua University, agrees. Liu says investors should not just focus on 2012, but should make long-term investment plans in environment-friendly facilities and carbon trading.

(For more biz stories, please visit Industries)

|