|

BIZCHINA> Top Biz News

|

|

Growth enterprise board may significantly boost VC market

By Bi Xiaoning (China Daily)

Updated: 2009-04-27 08:02  Chinese authorities recently called for speeding up the establishment of the NASDAQ-like growth enterprise board (GEB), an idea that has been talked about for almost 10 years. "A GEB not only opens a new financing channel for the country's many small- and medium-sized enterprises (SMEs) but also offers a convenient exit channel for venture capitalists," said Shen Nanpeng, founder and partner of Sequoia Capital China, a three-year-old unit of US-based Sequoia Capital. Limited exit channels have always troubled foreign and domestic venture capitalists keen on tapping China's fast charging economy. When times were good, as they were for much of the past decade, the issue wasn't much of a concern because overseas listings, in Hong Kong or on the NASDAQ, were not only possible but also welcomed by global investors.

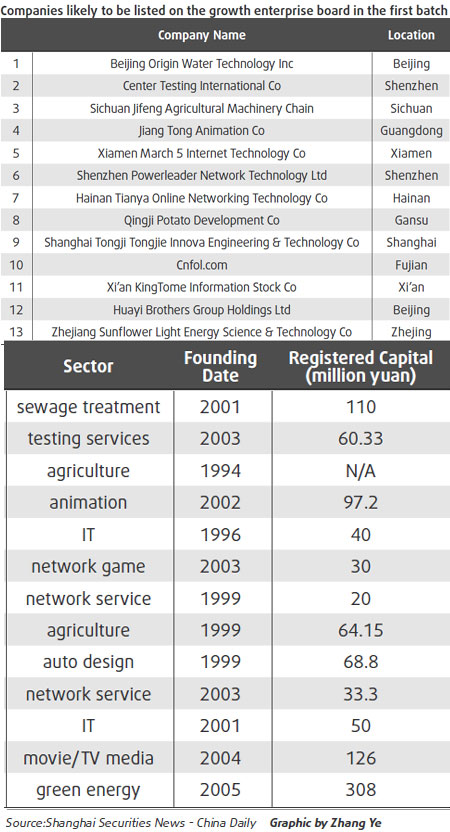

"The GEM gives us great hope. The country's VC companies can develop more rapidly in a multi-level capital market," said Jin Haitao, chairman of Shenzhen Capital Group Co Ltd, a Chinese VC firm founded in 1999. China's securities regulator released guidelines on March 31 to establish the long-awaited GEB. The preparation work, which includes drafting specific transaction regulations and educating professional agencies and investors, may take several months. Companies with potential to get listed on the GEB became favorites for VC companies. "A NASDAQ-like market in China is important to us because selling shares directly to the public usually yields higher investment returns than merger and acquisitions (M&A) or other exit channels," said Ye Guantai, general manger at Highland Capital Partners, a joint venture backed by a US fund. Specific regulations on the lockup period haven't been released yet. "The to-be launched GEB could help VC firms to shape a smooth cycle of investment, value-added increment, exit and new investment, which could dramatically boost the VC market," said Gongmeng Chen, director of the China Venture Capital Research Institute. There were over 400 VC firms registered in China by the end of February. According to market researcher Zero2IPO, VC firms have played an active role in China's capital market, which invested about $15 billion in 3,176 projects in China from 1999 to 2008. Over the past 10 years, about 191 venture capital-backed Chinese companies were listed domestically or overseas, with a combined market value of over $80 billion. Industry analysts said a considerable capital supply and abundant company resources are critical to launch the GEB in China. "Innovative Chinese companies can expect ample capital support from the VC companies, which have about $25 billion of capital on hand now, including $16 billion from foreign VC companies," said Zero2IPO CEO Ni Zhengdong. According to the Shenzhen Stock Exchange, the bourse for the GEB, over 300 companies from 29 economic development zones over the country are preparing to list on the GEB. "Currently we have equity rights in 148 companies, 60 of which meet the basic requirements of the GEB, especially for high growth rates and innovation," said Li Wanshou, president of the Shenzhen Capital Group. According to Li, the innovative companies engaged in green energy, communication equipments, modern agriculture and pharmaceutical healthcare are some of the most attractive for VC firms. Domestic VC firms may be actively preparing for the GEB but foreign VC companies are still waiting, since current regulations limit listing to domestic companies. "Foreign funds are also in need of exit channel. But there is no clear regulation allowing joint venture firms to get listed on the GEB," said Xu Chen, a partner of Gobi Partner, a joint venture back by an US fund. We are waiting for detailed rules. But the venture capital market in China may be about to take off," Xu added.

(For more biz stories, please visit Industries)

|

|||||