|

BIZCHINA> Top Biz News

|

|

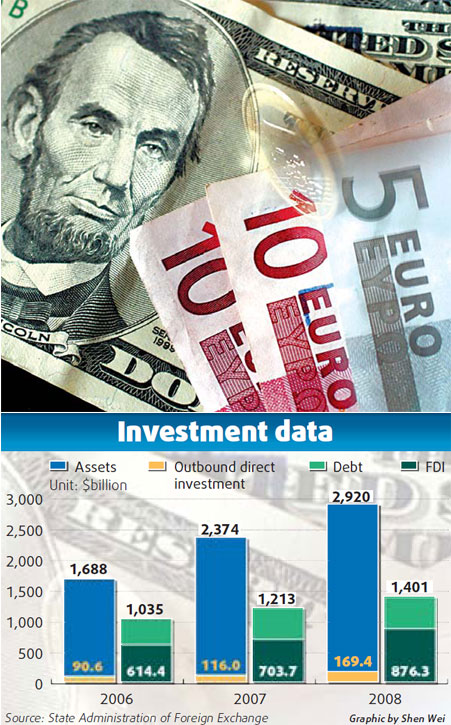

Overseas assets in 2008 soar to $2.92t

By Fei Ya (China Daily)

Updated: 2009-05-20 08:12

China's foreign financial assets rose 23 percent last year to reach a total of $2.92 trillion, the State Administration of Foreign Exchange (SAFE) said yesterday. Of that amount, nearly $2 trillion, or 67 percent, were foreign exchange and gold reserves, the foreign exchange regulator said. The outbound direct investment, however, was just $169.4 billion, accounting for 6 percent of the total foreign financial assets.

Domestic institutions will be able to buy foreign exchange or use foreign currency owned by themselves or borrowed from Chinese banks to invest abroad. The institutions can also reinvest the profit from overseas investments, according to the draft rule. The easing of foreign exchange control on domestic companies' outbound direct investment is likely to help the country manage its foreign exchange more prudently, experts said. "Encouraging the use of foreign exchange at the enterprise level will help ease SAFE's pressure in managing the huge foreign exchange reserves," said Han Qi, professor, University of International Business and Economics. Guo Tianyong, professor, Central University of Finance and Economics said that companies could be more efficient in using foreign exchange than State-level entities. "Encouraging Chinese companies to directly invest overseas may also help shift the focus on dollar-denominated assets," Guo added. "The country's foreign investment has so far focused on dollar-denominated financial assets, and the measure is expected to diversify the portfolio," said Li Zhikun, economist, China Jianyin Investment Securities said. The foreign exchange administrative body also said on Monday that it plans to ease approval procedures as part of revised rules. It said companies would now be able to register the source of their foreign currency funding after investing abroad instead of the pre-investment vetting required now. SAFE would also standardize the procedure for companies to seek approval for foreign investments, instead of the case-by-case system. But it added that any significant foreign investment would still require approval from other authorities. "This is aimed at implementing the 'going out' development strategy as well as for promoting and facilitating overseas direct investment by domestic institutions," SAFE said in the statement on its website. Meanwhile, China's Ministry of Commerce has urged domestic companies to ramp up overseas investments. "The global financial crisis has made a profound adjustment to world economic geography," the ministry said in a statement on its website. Fan Chunyong, deputy chairman of China Industrial Overseas Development & Planning Association pointed out that China's overseas investments are improving as the country has changed from being a "product manufacturer" to a "capital investor". "China's overseas investments may exceed foreign direct investment this year largely due to the stimulus plans," Fan said. The country's outbound foreign direct investment nearly doubled to $52.2 billion in 2008 from $26.5 billion in 2007. If this has to exceed the inbound FDI this year, it would mean an outbound foreign direct investment of nearly $80 billion, according to some experts. The SAFE draft rule also for the first time mentioned that Chinese companies could directly invest overseas by using the renminbi as the settlement currency. "Chinese companies who plan to use renminbi to invest abroad should, however, follow the relevant rules," SAFE said. Experts noted that this was the first time that the country has talked about renminbi-denominated overseas investments, thereby providing the foundation for the currency's internationalization. "There is no doubt that in the future, renminbi will be widely used in cross-border trade and investments," Li from Jianyin Investment Securities said. (For more biz stories, please visit Industries)

|

|||||