|

BIZCHINA> Top Biz News

|

|

China's consumer prices fall for 4th month

(Agencies)

Updated: 2009-06-10 12:44

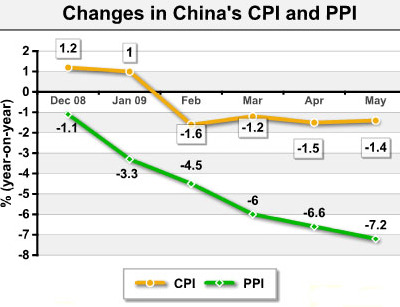

Chinese prices fell in May for a fourth month as food and energy costs declined from last year's high levels, data showed Wednesday, giving the government a freer hand to carry out its huge stimulus plan. The consumer price index for May declined 1.4 percent from a year earlier, the National Bureau of Statistics reported. The price of pork, China's staple meat, plunged by 32 percent and that of fresh vegetables by 22.2 percent. A prolonged bout of falling prices can cause economic problems, but the recent declines were expected and are due in part to the fact that this year's prices are being compared with a period of high inflation in 2008.

Consumer prices fell 1.5 percent in April, 1.2 percent in March and 1.6 percent in February. "Deflation should begin to moderate in the coming months and turn into mild inflation in the second half," Jing Ulrich, JP Morgan's chairwoman for China equities, said in a report to clients. "The improving global economic outlook and high levels of liquidity should lend some support to prices."

Last year's price surge was driven by shortages of pork and grain. Inflation rose to a 12-year high of 8.7 percent in February 2008 before government efforts to increase supplies took hold and curbed rapid price rises. China's 4 trillion yuan ($586 billion) stimulus is meant to boost growth through higher spending on construction and other public works. Rising auto sales, bank lending and spending on real estate are seen by analysts as signs the plan is working, though demand for Chinese exports is weak. Economists expect consumer prices to continue to decline in coming months, possibly through the third quarter of this year. Prolonged deflation can drag down growth as consumers curtail spending in expectation of lower prices. But most economists say China is unlikely to face that problem. Consumer spending should rise as a recent rebound in the Chinese stock market and home prices fuels a "wealth effect," increasing consumers' confidence about household finances, said JP Morgan's Ulrich. (For more biz stories, please visit Industries)

|