|

BIZCHINA> Top Biz News

|

|

Morgan Stanley raises 2009 growth forecast

By Si Tingting (China Daily)

Updated: 2009-07-21 08:01 Investment bank Morgan Stanley has raised its 2009 GDP growth rate forecast for China to 9 percent from 7 percent earlier. It has also upped its forecast for 2010 to 10 percent from the 8 percent previously, according to a recent report by Morgan Stanley economist Qing Wang. "This automatically raises our implied earnings view and index multiples for the Hang Seng China Enterprises Index (HSCEI)," Jerry Lou, China strategist of Morgan Stanley, said at a media briefing yesterday.

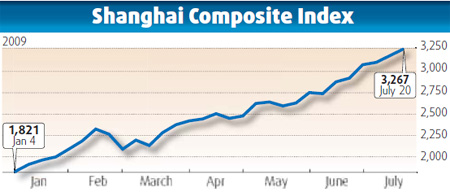

As the economic recovery is not yet full-fledged, Lou believes the government would not officially opt for a tight monetary policy - despite a series of micro-tightening efforts - before the second half of 2010. "We assume there would be two rate increases in the second half of 2010," he said. Chinese stocks jumped 2.42 percent to a fresh 13-month closing high yesterday while turnover surged to its highest in nearly 26 months, with metal and coal shares ending higher after data reinforced investor faith in a strong third-quarter outlook for the economy. The Shanghai Composite Index ended at 3266.92 points, posting its biggest one-day percentage gain in seven weeks. The gauge has surged 79 percent this year as banks tripled new loans to 7.37 trillion yuan ($950.94 billion) in the first half from a year earlier and the government implemented a stimulus package. "The best way to profit from this bullish economic outlook, in our view, is through the consumer and industrial sectors," Lou said, adding that the growth laggards, such as consumption and industrials will have to catch up during the economic boom. The strategy is to avoid sectors sensitive to monetary and fiscal policy, such as banks, property and materials, because they are too close to the "policy exit". These sectors, according to Lou, were also the early beneficiaries of the stimulus-driven economic recovery.

(For more biz stories, please visit Industries)

|

|||||