|

BIZCHINA> Top Biz News

|

|

Profit-taking takes sheen off metal prices

(China Daily/Agencies)

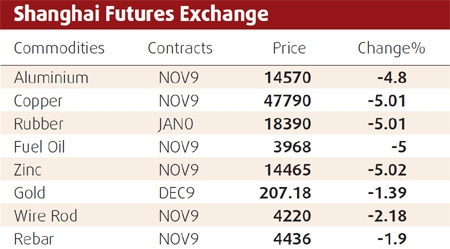

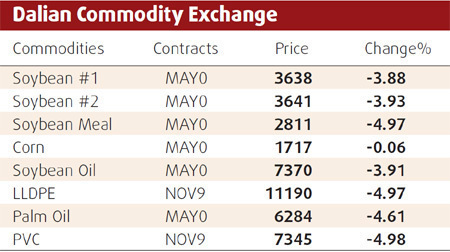

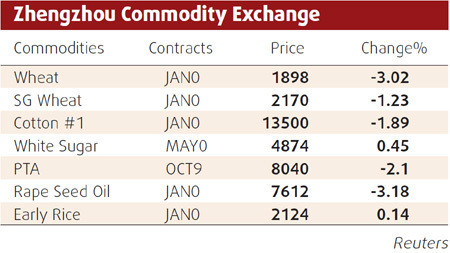

Updated: 2009-08-18 08:04 Industrial metals prices fell yesterday under pressure from profit taking after a surge in Shanghai copper stocks to a two-year high and soft US consumer confidence data prompted a cross-market sell-off. Shanghai copper and zinc both fell by their 5 percent daily limits and aluminum was also sharply down, while London nickel slumped 6 percent and copper shed almost 3 percent, adding to Friday's 2.4 percent loss when the market slid from 10-month highs. "It was all a bit too fast and a bit too easy and the whole market was ready for the correction," a dealer in Sydney said. "Copper seems to be holding $6,000 for now, but that may face pressure later in the day when we get new data." A weaker-than-expected reading from the Reuters/University of Michigan Survey of Consumers and a 20-percent surge in weekly Shanghai copper stocks to 76,107, their highest in two years, ignited Friday's cross-market sell-off. Asian equity markets joined those in the US and Europe which dropped on Friday and oil started the week 1.5 percent down at $67 a barrel, having shed $4 on the numbers of Friday that showed Americans grew increasingly worried over jobs and wages. "People are getting out of commodities, energy and equity markets. They have seen handsome gains in the past few months so who can blame them?" said a dealer in Hong Kong. "Trade is fairly thin. Prices are very choppy and few of my clients want to leave money on the table overnight given the fading confidence in a quick US recovery."

"Long-term players are buying the dip, if you can call $6,100 a dip. I see support between $5,800 and $6,000, which would be a return to the previous ranges," a trader in Singapore said.

"The market has come up a long way so there is potential for some short-term weakness, but fundamentally, we remain positive. We are seeing selling from Chinese accounts," Barclays Capital analyst Yinggxi Yu said. "I think this is profit taking and positioning after the run-up." Copper prices have jumped more than 20 percent since the end of June. Shanghai copper traded 663 yuan above the LME benchmark accounting for Chinese VAT, making imports unprofitable. Shanghai zinc fell 760 yuan from Friday's settlement to 14,375 yuan. LME zinc lost 2.2 percent to $1,785 while nickel tumbled as much as 6.2 percent before recovering to $18,575, down 4.7 percent from Friday's last open outcry. "Nickel always overshoots - on the way up and the way down. The recent rally to $21,000 was overdone and this pullback seems reasonable," said Shanghai-based Bonnie Liu, analyst at Macquarie.

(For more biz stories, please visit Industries)

|

|||||