|

BIZCHINA> Top Biz News

|

|

Weaker dollar boosts copper

(China Daily/Agencies)

Updated: 2009-09-09 08:11 A softer dollar and stronger equities buoyed copper yesterday, though gains appeared fragile on persistent worries about the pace of the global economic recovery. The dollar's weakness and uncertainty about the global economy also pushed gold above $1,000 an ounce for the first time in six months. Battery material lead climbed nearly 3 percent to a high of $2,415 a ton, its best level since early May 2008 on continuing supply worries following smelter shutdowns in China due to pollution concerns. Analysts are looking to China's trade data due out on Friday which is expected to show that imports of the world's top copper consumer may have dropped for the second straight month in August due to increased inventories from record imports in the first half.

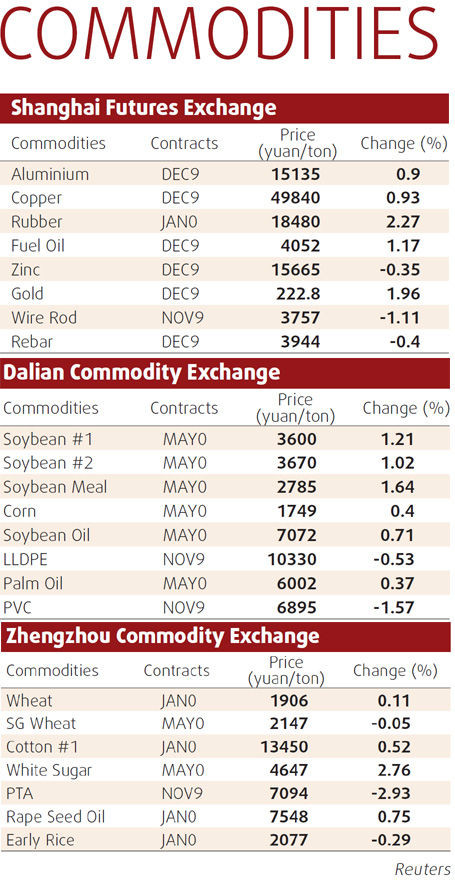

"But I think base metal prices might correct lower in the next three to six months given the build in stocks recently and also the softer level of China's imports." Three-month copper on the London Metal Exchange rose by $71 to $6,395 a ton in early trade, extending Monday's $44 gain. Shanghai's benchmark third-month copper rose 340 yuan to 49,880 yuan a ton while the most-active December contract added 320 yuan to 49,840 yuan. "Investor sentiment is still heavily biased towards the 'recovery trade', and the generally decent macro numbers that are coming out should continue to support this view," MF Global commodity analyst Edward Meir said. Rubber futures also declined amid speculation that rising supplies in China will cap prices, said Shuji Sugata, research manager at Mitsubishi Corp Futures & Securities Ltd. January-delivery rubber on the Shanghai Futures Exchange added 1.4 percent to settle at 18,315 yuan ($2,682) a ton.

(For more biz stories, please visit Industries)

|

|||||||