|

BIZCHINA> Top Biz News

|

|

New stock account openings decline

(China Daily/Agencies)

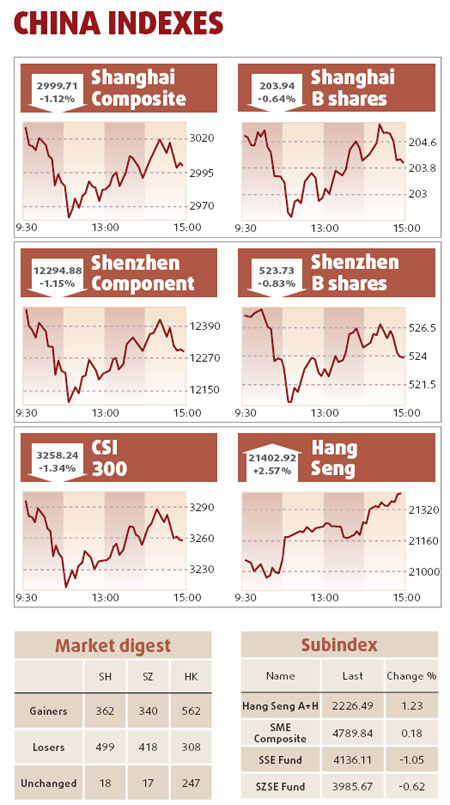

Updated: 2009-09-17 08:07 Chinese investors are opening accounts to trade stocks in the smallest numbers in three months after the Shanghai Composite Index entered a bear market and initial public offerings dried up. Individual investors opened 324,856 accounts last week, data from the nation's clearing house showed yesterday, the least since the five days ended June 5 and a sixth week of declines. The Shanghai index tumbled 22 percent in August, entering a bear market or a decline of 20 percent from a recent peak, on speculation a plunge in new lending would derail recovery in the world's third-largest economy. Last week's new account figure is less than half the 700,000 registered in the last week of July, when investors were rushing to buy equities following the end of a ban on initial public offerings (IPOs) and a rebound in economic growth. China State Construction Engineering Corp received 1.85 trillion yuan of bids for its share sale that month, more than the capitalization at the time of Norway's and Russia's stock markets. The Chinese index is the best performer globally in the year since the collapse of Lehman Brothers, advancing 46 percent at Tuesday's close. Stocks rallied after the government introduced a 4 trillion yuan stimulus package and encouraged banks to increase lending. The benchmark index fell yesterday for the first time in four days, led by brokerages, as investors opened fewer share trading accounts for a sixth week, and on concern recent gains were excessive relative to prospects for earnings growth. CITIC Securities Co and Haitong Securities Co, the country's top two brokerages, slid more than 2 percent. Anhui Jianghuai Automobile Co, the nation's biggest light-truck exporter, lost 1.8 percent after a major shareholder reduced its stake. Zijin Mining Group Co, China's largest gold producer, climbed 5.2 percent as bullion traded above $1,000 an ounce for a fourth straight day. "The concern is whether the economic recovery can be sustained or if corporate earnings are improving," said Larry Wan, deputy chief investment officer at KBC-Goldstate Fund Management Co. The market needs "further catalysts", he added. The Shanghai Composite Index fell 34.02, or 1.1 percent, to 2,999.71 at the close. The CSI 300 Index slid 1.3 percent to 3,258.24.

(For more biz stories, please visit Industries)

|