|

BIZCHINA> Top Biz News

|

|

Domestic firms face tough battle for top oil assets

(China Daily/Agencies)

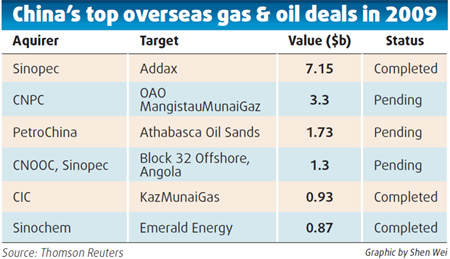

Updated: 2009-10-24 07:44 China's State-owned oil giants are likely to lose out to global rivals in a race for top energy assets, as they lack experience and hit a protectionist wall, forcing them to settle for smaller, but riskier buys. This inability to buy top assets could limit growth potential at PetroChina, Sinopec and CNOOC, and put CNOOC at risk of missing its ambitious production targets, analysts said. Kosmos Energy's recent decision to award its prized Jubilee oil field stake in Ghana to Exxon Mobil over CNOOC is the latest sign that Chinese energy companies are not ready for oil prime time, bankers said. "The other (oil field) partners like Tullow and Anadarko would probably prefer Exxon to be successful as it has greater technical capability," said David Hewitt, an analyst with CLSA. Chinese oil firms are already being hemmed in by recent consolidation that has limited the number of assets on the global market. Protectionism has also limited their options in markets from Australia to the US.

"The challenge they face in large corporate deals is one of resource nationalism," said Neil Beveridge, an analyst with Sanford C. Bernstein. With so many options off the table, remaining possibilities could include Canadian oil firm Opti Canada Inc, which may be on PetroChina's radar, and its peer Nexen Inc, which CNOOC and CNPC may be interested in, bankers said.

(For more biz stories, please visit Industries)

|