|

BIZCHINA> Top Biz News

|

|

Copper subdued as dollar recovers

(China Daily/Agencies)

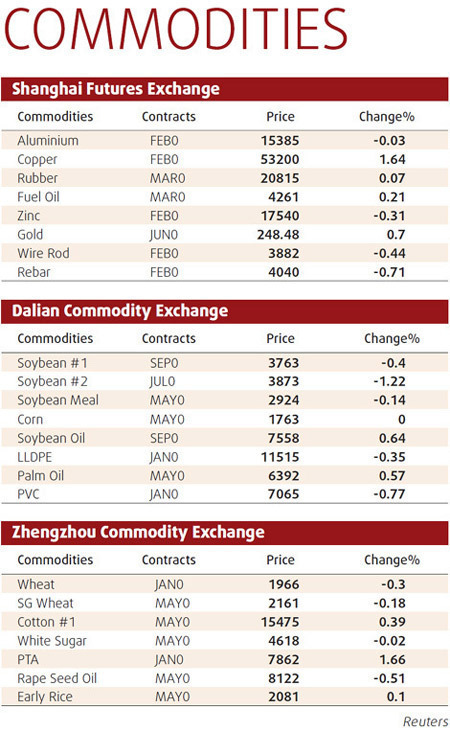

Updated: 2009-11-18 07:58 Shanghai copper came off near 14-month highs yesterday as equities retreated and the dollar edged up from multi-month lows, and London futures eased as investors locked in recent gains. Profit-taking also hit Asian stocks as the US currency regained some ground versus a basket of currencies after falling to 15-month lows in the previous session following US Federal Reserve Chairman Ben Bernanke's reiteration that the central bank was likely to keep interest rates at very low levels for some time. Copper jumped to 13-month peaks in London on Monday as a weaker dollar and better-than-forecast US retail sales boosted sentiment. "In my view, base metals are quite fully valued, with investors pricing in bullish assumptions for the international economy," said David Moore, commodity strategist at Commonwealth Bank of Australia. "At some point, we'll see some pullback in prices."

Shanghai's benchmark third month copper rose 450 yuan to close at 53,200 yuan a ton, after hitting a high of 53,840 yuan earlier, its loftiest since Sept 23, 2008. The early and heavy snow in northern China is also supporting sentiment on potential output disruption and expectations of firmer copper demand to rebuild any damaged power infrastructure, said Shao Hebin, an analyst at Great Wall Futures in Shanghai. But Shanghai copper has not kept pace with the strong gains on the LME, having touched 13-month highs already on Monday, traders said. "The local market also expects LME prices to retrace so the gains in Shanghai are smaller," said Shao. Elsewhere, Shanghai zinc added 35 yuan to 17,540 yuan, off a high of 17,770 yuan, its best since late May last year. "In the longer run, zinc prices can strengthen quite strongly as the zinc market will ultimately tighten up," said Commonwealth's Moore. In other industry news, the growth of China's real consumption of nickel is expected to slow to 5.1 percent next year after a 37.6 percent surge this year as the stainless steel market digests stocks, a senior analyst at research group Antaike said. LME nickel dropped $100 to $16,700 a ton.

(For more biz stories, please visit Industries)

|

|||||||