|

BIZCHINA> Top Biz News

|

|

Power stocks boost mainland equities

(China Daily/Agencies)

Updated: 2009-11-19 08:07 Chinese stocks rose, driving the benchmark index to its highest in more than three months, as energy producers and utilities advanced after snowstorms boosted demand for power. Real estate developers declined.

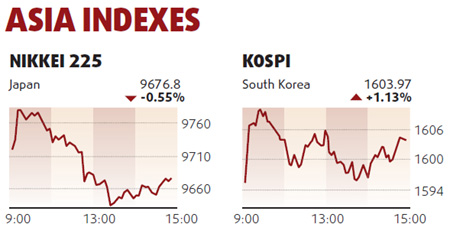

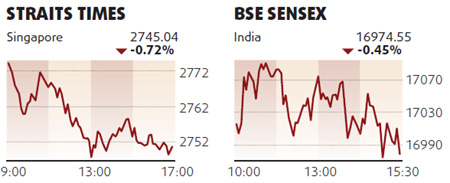

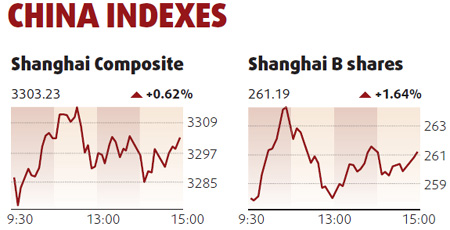

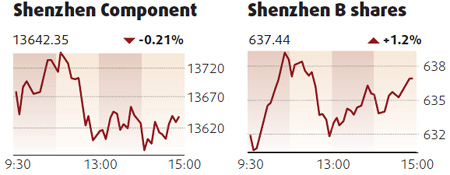

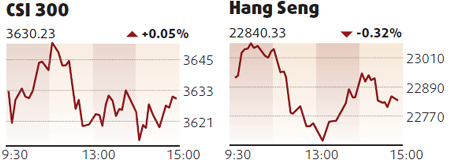

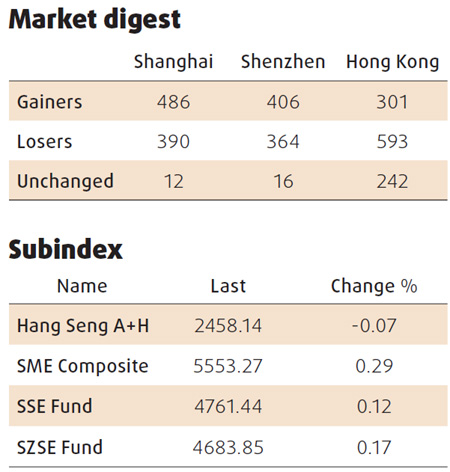

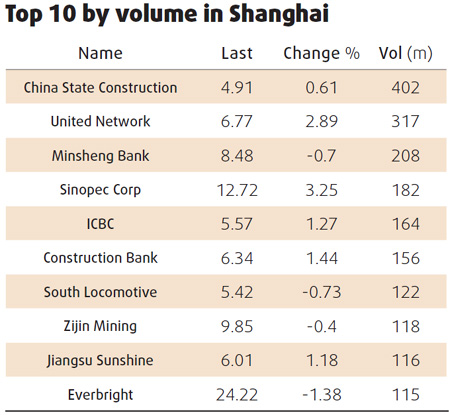

China Shenhua Energy Co, the nation's top coal producer, added 1.5 percent to 37.99 yuan ($5.56) and Shanghai Electric Power Co, which supplies the commercial hub, rose 6.7 percent to 6.25 yuan as some areas of the country experienced the heaviest snowfall in a century. China Petroleum & Chemical Corp climbed 3.3 percent to 12.72 yuan and PetroChina Co gained 1.2 percent to 14.01 yuan on speculation the government may speed up plans to reform natural gas pricing. Poly Real Estate Group Co, the nation's second-biggest developer, slipped 1.3 percent to 26.7 yuan after central bank advisor Fan Gang said the city of Shenzhen will introduce a property tax. A measure tracking Shanghai-traded property stocks is the only one that dropped yesterday among the five industry groups. "Power producers are benefiting from increased electricity demand due to the cold weather," said Liang Yumei, Beijing-based analyst at Shanxi Securities Co. The Shanghai Composite Index advanced 20.35, or 0.6 percent, to 3,303.23 at the close, a fourth day of gains and the highest since Aug 6. The measure has rallied 19 percent this quarter, the world's second-best performer. Stocks on the index trade at 35.02 times earnings, almost three times last year's low. "The domestic market looks pretty fairly valued at the moment," Chris Ruffle, China co-chairman in Shanghai of Edinburgh-based Martin Currie, which manages $19 billion, said in a Bloomberg Television interview yesterday. The CSI 300 Index added 0.1 percent to 3,630.23, while the Shenzhen Composite Index rose 0.3 percent to 1,188.47, rising for 14 consecutive days. That's the longest winning streak since Bloomberg began to track the measure in 1992. Hang Seng declines Hong Kong stocks dropped after central bank advisor Fan Gang said the nation is among the emerging nations facing risks of market bubbles.

The Hang Seng Index slid 0.3 percent to close at 22,840.33, reversing a gain of as much as 0.8 percent. Shares in the Hang Seng Index trade at 156 times estimated cash flow for this year, compared with 8.9 times for the Shanghai Composite Index and 9.6 times for the Standard & Poor's 500 Index in the US, according to data compiled by Bloomberg. The Hang Seng China Enterprises Index fell 0.3 percent to 13,688.01.

(For more biz stories, please visit Industries)

|

|||||||